SEO Isn't Dead. But It's Not Fine Either.

There are two camps right now in digital marketing.

Camp one says SEO is dead. AI Overviews killed it. ChatGPT ate it. Pack it up, the clicks are gone forever.

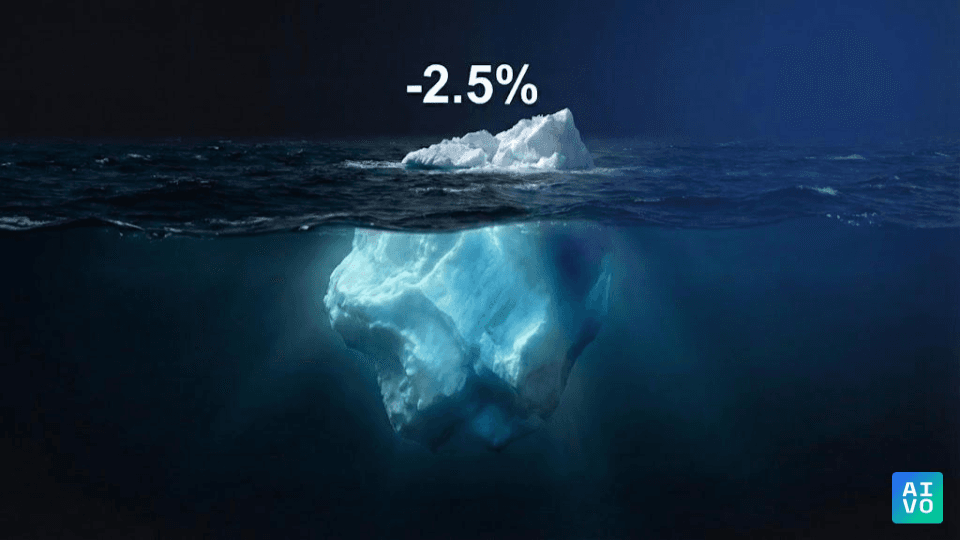

Camp two points to the data and says relax. Graphite just published research showing organic traffic is only down 2.5% year-over-year. The sky isn't falling. SEO is fine.

I'll be honest: I've spent time in camp one. When AI Overviews started answering queries directly on the SERP, it felt like watching the end of something. Many of us in the AI visibility space called the death too early.

But here's the thing—the "everything is fine" narrative is just as wrong. Maybe more dangerous, because it encourages inaction.

The truth is messier than either camp wants to admit. And for mid-market brands trying to figure out where to invest, that mess matters.

📋 TL;DR (Key Findings)

- "SEO is dead" was wrong—organic search still drives the most traffic and validates AI recommendations

- "Everything is fine" is also wrong—2.5% decline while search volume grew 20% signals a structural shift

- The K-shaped reality—top 10 sites grew 1.6%, mid-market sites declined in double digits

- Click-through collapse—queries with AI Overviews saw 61% CTR drop for organic results

- Zero-click dominance—nearly 60% of searches now result in no click to the open web

- Share of Model matters—when AI recommends competitors instead of you, traditional SEO won't save you

Why "SEO Is Dead" Was Wrong

Let's give credit where it's due.

The Graphite study, using Similarweb data across the top 40,000 websites, shows that organic search traffic declined by just 2.5% in 2024 [1]. That's not the collapse many predicted. Organic search is still the single largest source of website traffic for most businesses. It's not going anywhere.

More importantly, SEO still plays critical roles that AI can't replace:

Validation. Users are developing a new behavior pattern—they ask AI for recommendations, then search Google to verify. "Is this brand legit?" "What do reviews say?" Search is becoming the trust layer.

Transaction. You can't buy a product inside an AI Overview. You can't sign up for a SaaS tool in a ChatGPT response. When users are ready to act, they still need to visit your site. Those visits still come through search.

Foundation. Here's the part most people miss: AI models learn from indexed content. If you're not ranking, you're likely not in the training data. SEO feeds the machine that's supposedly killing SEO.

So no, SEO isn't dead. The people saying that were wrong, myself included.

But that doesn't mean the "modest decline" story is right either.

Why "Modest Decline" Is Also Wrong

Let's look at what that 2.5% number actually means.

The math doesn't add up

Google search volume grew by approximately 20% in 2024 [3]. Twenty percent more searches happened. Yet organic traffic to websites declined by 2.5%.

If demand grows by double digits while supply to publishers shrinks, that's not stability. That's a collapsing capture rate. The pie is getting bigger, but the slice going to the open web is getting smaller. Google is transitioning from a distribution utility to a destination platform.

In any other context, we'd call this a recession. If the economy grew 5% annually for 25 years and then contracted 2.5%, no economist would call that "stable." They'd call it a structural shift.

The K-shaped reality

The aggregate number hides a brutal distribution. The Graphite study itself notes that the top 10 websites actually grew organic traffic by about 1.6% [1]. These are the giants—Reddit, Wikipedia, Amazon, LinkedIn—domains that Google's algorithms (and AI systems) trust implicitly.

Meanwhile, websites ranked 100 to 10,000—the mid-market, the independent publishers, the specialized e-commerce brands—saw the sharpest declines [1]. When you weight the growth of giants against everyone else, the median decline for mid-market sites is likely in double digits.

The stability is survivorship bias. The giants are fine. Everyone else is getting squeezed.

Navigational vs. informational

There's another problem with the top 40,000 data set. A huge portion of organic traffic to major sites is navigational—people typing "YouTube" or "Amazon Prime" or "Facebook login" into the search bar.

That's not discovery. That's glorified direct traffic. An AI Overview will never intercept someone trying to log into their bank account.

When you isolate non-brand, informational queries—the ones that actually drive new customer acquisition—the decline is far worse than 2.5%. The methodology acts as a sedative, masking acute trauma in the discovery layer.

The Great Decoupling

The real story isn't in traffic numbers. It's in the relationship between impressions and clicks.

For twenty years, these metrics moved together. More visibility meant more visits. That relationship is breaking.

The click-through collapse

Data from Seer Interactive quantifies the damage. For search queries where an AI Overview appears, organic click-through rates dropped 61% year-over-year—from 1.76% to just 0.61% [8]. Paid search CTRs fell 68% in the same conditions [8].

Users are getting their answers on the SERP. The click never happens.

The zero-click reality

Rand Fishkin's research shows that nearly 60% of searches now result in no click to the open web [9]. That number is climbing. Google is hoarding the user journey.

The -2.5% traffic decline is the tip of the iceberg. The mass below the waterline is a 60% loss in click-through efficiency for the queries that matter most.

Which queries are dying

Not all searches are affected equally. Semrush data shows that 91% of AI Overviews are triggered by informational queries—the "what is" and "how to" content that publishers built empires on [10].

When an AI summary provides a complete answer to "benefits of vitamin D" or "how to write a cover letter," the utility of clicking approaches zero. The user wins. The publisher loses.

Transactional queries remain more resilient. Users still need to visit sites to buy, book, or sign up. But informational content—the top of the funnel, the awareness layer—is being absorbed into the search interface itself.

Ahrefs research corroborates this: when an AI Overview is present, the CTR for the top-ranking page drops by 34.5% compared to similar keywords without an AIO [11].

The new user behavior

What's emerging is a hybrid pattern:

- Synthesis phase: User asks AI to compare options, explain concepts, narrow choices. Zero click.

- Verification phase: User searches Google to validate the AI's recommendation. Branded or review-focused query.

- Transaction phase: User visits the chosen site to complete an action.

What This Actually Means

So where does this leave SEO strategy?

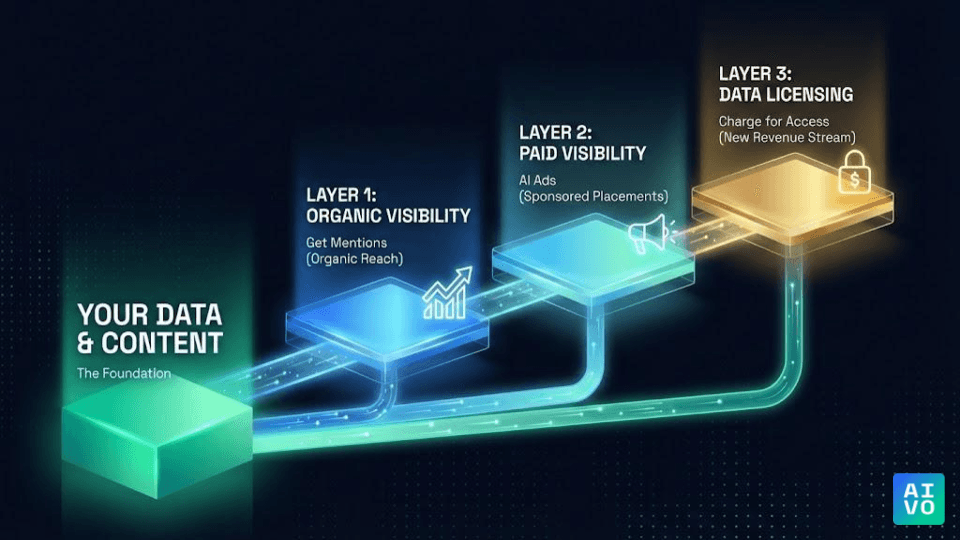

SEO is the foundation, not the ceiling

Your indexed content is what trains AI models. The pages you've optimized, the authority you've built, the structured data you've implemented—all of it feeds the systems that are now answering user questions directly.

If you abandon SEO, you disappear from the training data. You become invisible not just to Google, but to every AI that learns from the web.

SEO is table stakes. Necessary, but no longer sufficient on its own.

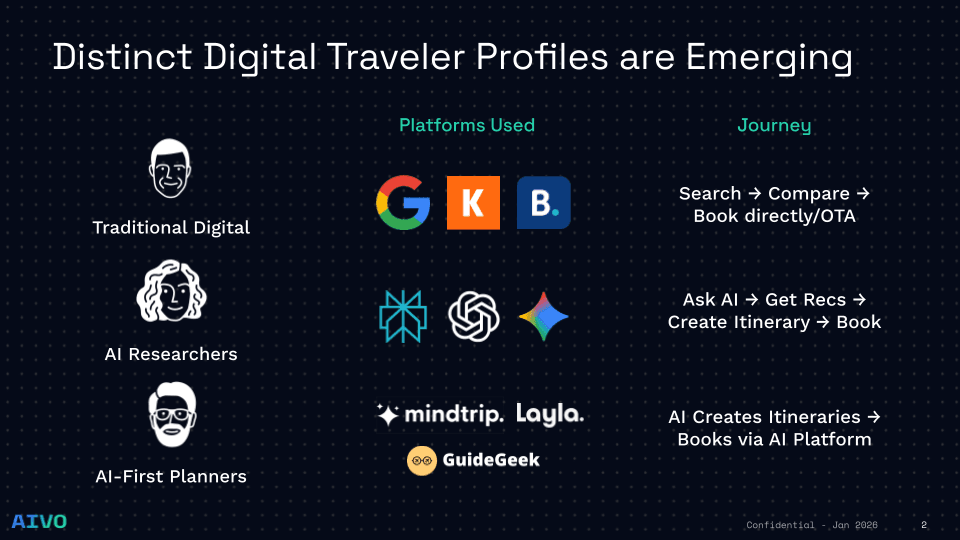

The new metric: Share of Model

There's a question that matters more than your ranking position: When someone asks an AI for recommendations in your category, do you appear?

You can rank number one on Google and be completely invisible to ChatGPT. The systems don't always correlate. A brand that dominates search might not exist in the AI's response [26].

Share of Model—how often AI recommends you for relevant queries—is becoming the metric that matters. It's harder to measure than search rankings, but it's where competitive advantage is shifting [27].

The attribution black hole

Here's a practical problem: AI-driven visits often don't show up correctly in analytics.

When a user asks ChatGPT for product recommendations, copies a URL from the response, and pastes it into their browser, that visit registers as "Direct" traffic. No referrer. No attribution [19]. The AI did the selling, but your analytics never saw it.

A significant percentage of traffic that should be attributed to AI discovery is hiding in your Direct bucket right now. The -2.5% decline in visible search traffic might be accompanied by invisible growth in AI-influenced visits.

You're possibly getting value you can't measure. That's a strategic problem.

What to do about it

The answer isn't to abandon SEO. It's to expand what you measure.

Continue optimizing for search—it feeds the foundation. But start tracking your presence in AI responses alongside your search visibility. Know where you appear when someone asks ChatGPT, Claude, Perplexity, or Gemini for recommendations in your category.

Most brands have no idea. They're optimizing one channel while ignoring the one that's reshaping how customers discover products.

Platform-Specific Optimization

ChatGPT Optimization

ChatGPT uses Bing + SerpAPI (Google hybrid) with unpredictable citation patterns:

- Optimize for both Bing AND Google simultaneously

- Use highly structured content (tables, lists, clear headings)

- High information density—avoid fluff

- Educational tone over promotional copy

- Allow GPTBot and OAI-SearchBot in robots.txt

Perplexity Optimization

Perplexity searches every query using Google as primary backend:

- Focus on Google rankings as foundation

- Build authority through citations from trusted sources

- Display publication dates prominently and update quarterly

- Use FAQ and HowTo schema markup extensively

- Allow PerplexityBot in robots.txt

Claude AI Optimization

Claude has 87% correlation with Brave Search results:

- Check rankings on search.brave.com

- Use recency signals ("2026", "latest") in H1s and opening paragraphs

- Structure for extraction: short, clear sentences (15-25 words)

- Allow ClaudeBot in robots.txt

Google AI Overview Optimization

Minimize AI Overview triggers for high-value queries, or optimize when AIO is unavoidable:

- Use scannable bullet points and lists

- Provide direct answers to specific questions

- Implement Featured Snippet optimization techniques

- Consider targeting queries less likely to trigger AIOs

FAQ

How can I measure Share of Model for my brand?

Start with manual testing: ask ChatGPT, Claude, Perplexity, and Gemini questions your customers would ask. Document whether your brand appears. For automated tracking, platforms like AIVO provide systematic Share of Model monitoring across multiple AI engines. Track frequency of mentions, context of citations, and competitive positioning.

Is the 2.5% decline really that bad compared to 25 years of growth?

Context matters. This isn't a natural plateau after growth—it's happening while search volume grew 20%. The capture rate is collapsing. For mid-market brands (not the top 10 giants), the actual decline is likely 10-15%. When you isolate informational queries (not navigational), it's even worse.

Should I stop investing in SEO?

No. SEO remains foundational because: (1) it feeds AI training data, (2) it drives verification traffic after AI discovery, (3) it captures transactional intent. But treating SEO as sufficient is dangerous. You need parallel investment in AI visibility to capture the discovery phase.

How do I track AI-driven traffic if it shows up as "Direct"?

Look for patterns: spikes in direct traffic after AI platform feature launches, branded search increases without corresponding ad spend, conversions from users who claim they "heard about you from ChatGPT." Advanced attribution requires UTM parameter strategies and correlation analysis between AI mention frequency and traffic patterns.

What's the biggest mistake brands are making right now?

Assuming SEO success equals AI visibility. We've audited brands ranking #1 on Google who don't appear in ChatGPT responses at all. The opposite happens too—brands with weak search rankings getting cited by Claude due to strong Brave Search presence. The systems don't correlate perfectly.

How long until AI traffic exceeds traditional search traffic?

Current trajectory suggests 3-5 years for crossover in informational queries. Transactional queries will take longer. But market share matters more than total volume—if your competitors achieve high Share of Model while you optimize for declining search CTRs, you lose regardless of timing.

Is there a way to prevent AI Overviews from appearing for my target keywords?

Not directly. You can't block Google from showing AIOs for specific queries. However, you can influence likelihood: highly commercial queries trigger fewer AIOs, as do queries with strong local intent or those requiring real-time data. Focus SEO efforts on query types less likely to generate zero-click results.

Should I optimize content differently for AI platforms versus traditional search?

Yes and no. The foundation is the same (authority, relevance, technical SEO), but presentation differs. For AI extraction: shorter sentences (15-25 words), answer-first structure, clear data points, FAQ sections. For search: traditional SEO signals plus schema markup. The good news: optimizing for AI extraction often improves traditional search performance too.

Key Takeaways

The Reality Check

- SEO isn't dead—it remains essential as validation layer, transaction driver, and foundation for AI training data

- But it's not fine either—2.5% decline during 20% search growth is a collapsing capture rate, not stability

- The giants are thriving—top 10 sites grew 1.6% while mid-market brands (ranks 100-10,000) saw double-digit declines

- Zero-click is the crisis—60% of searches now generate no click to the open web; the iceberg metaphor is accurate

The New Metrics

- Share of Model matters more than rankings—if AI doesn't recommend you, traditional search position won't save you

- Attribution is broken—AI-driven visits hide in Direct traffic; you're possibly getting value you can't measure

- The three-phase journey—synthesis (AI), verification (search), transaction (website); SEO only captures phases 2-3

The Action Plan

- Continue SEO investment—it feeds AI training data and captures verification + transaction phases

- Add AI visibility tracking—measure presence in ChatGPT, Claude, Perplexity, Gemini responses for your category

- Optimize for extraction—structure content for AI citation: short sentences, answer-first, clear data points

- Accept the K-shape—mid-market brands face the steepest challenge; differentiation through AI visibility is critical

The Bottom Line

The "SEO is dead" crowd overcorrected. The "everything is fine" crowd is dangerously complacent. The truth: SEO remains foundational, but Share of Model is where competitive advantage is shifting. The first step is knowing where you stand today—not just in search rankings, but in AI visibility.

Implementation Roadmap

Immediate Actions (This Week)

- Test your brand's AI visibility—search for customer queries in ChatGPT, Claude, Perplexity

- Audit your top 10 informational pages for AI Overview triggers

- Review robots.txt to ensure AI crawlers are allowed (GPTBot, ClaudeBot, PerplexityBot)

- Check Direct traffic patterns for unusual spikes correlating with AI platform launches

Near-Term Strategy (30-60 Days)

- Implement Share of Model tracking across major AI platforms

- Restructure high-value content for AI extraction (15-25 word sentences, answer-first)

- Build FAQ sections on product/category pages with natural language questions

- Optimize for Brave Search (Claude backend), Bing (ChatGPT), and Google (Perplexity)

- Set up correlation tracking between AI mentions and branded search volume

Long-Term Evolution (90+ Days)

- Develop parallel content strategies: one for search ranking, one for AI citation

- Build authority with AI-preferred sources (citations from trusted domains)

- Consider data licensing strategy for proprietary content (Layer 3 monetization)

- Invest in attribution modeling that accounts for AI-influenced journey phases

Data Summary

| Metric | Data | Source |

|---|---|---|

| Organic traffic YoY | -2.5% | Graphite |

| Search volume growth | +20% | SparkToro |

| Top 10 sites growth | +1.6% | Graphite |

| Organic CTR drop (AIO) | -61% | Seer Interactive |

| Paid CTR drop (AIO) | -68% | Seer Interactive |

| Zero-click rate | ~60% | SparkToro |

| Informational AIO triggers | 91% | Semrush |

| #1 CTR drop (AIO present) | -34.5% | Ahrefs |

---

Want to See Where You Stand?

Get your free AI Visibility Snapshot and understand your brand's position across ChatGPT, Perplexity, Claude, and Gemini. Takes 2 minutes. No sales call required.

Get Your Free Snapshot: tryaivo.com

Questions about Share of Model? Email team@tryaivo.com

---

Sources & References

[1] Graphite/Similarweb - "Organic search traffic is down 2.5% YoY" https://searchengineland.com/organic-search-traffic-down-yoy-data-467748

[3] SparkToro - "Google Search Grew 20%+ in 2024" https://sparktoro.com/blog/new-research-google-search-grew-20-in-2024-receives-373x-more-searches-than-chatgpt/

[8] Seer Interactive - "AIO Impact on Google CTR" https://www.seerinteractive.com/insights/aio-impact-on-google-ctr-september-2025-update

[9] The Digital Bloom - "Zero-Click & AI Impact Analysis" https://thedigitalbloom.com/learn/2025-organic-traffic-crisis-analysis-report/

[10] Semrush - "AI Overviews Study" https://www.semrush.com/blog/semrush-ai-overviews-study/

[11] Ahrefs - "AI Overviews Reduce Clicks by 34.5%" https://ahrefs.com/blog/ai-overviews-reduce-clicks/

[19] TG - "AI Traffic Tracking Guide" https://www.wearetg.com/blog/ai-traffic-tracking/

[26] INSEAD - "Meet the Model: How to Market to LLMs" https://knowledge.insead.edu/marketing/meet-model-how-market-llms-and-sell-humans

[27] Hallam - "Share of Model: A Key Metric for AI-Powered Search" https://hallam.agency/blog/share-of-model-a-key-metric-for-ai-powered-search/

---

Author: Sebastian Pinzon is Co-Founder of AIVO, an AI Visibility Intelligence Platform helping mid-market brands optimize for Share of Model across ChatGPT, Claude, Perplexity, and Gemini. With 15+ years of experience at major agency holding companies (Publicis, WPP, OMG), he's now focused on helping brands navigate the zero-click future.

Connect on LinkedIn | tryaivo.com