AI Visibility in 2026: How Regional Adoption Is Reshaping Discovery Strategy

The global AI visibility strategy is a myth.

Brands that treat AI engine optimization as a single, universal playbook are already falling behind. The data shows a clear pattern: how people discover information through AI looks fundamentally different depending on where they are. North America, Latin America, and Europe are each building distinct AI ecosystems with different dominant platforms, user behaviors, and decision criteria.

For any brand thinking about AI visibility strategy in 2026, the first question isn't "how do we optimize for ChatGPT?" It's "which AI engines actually matter in our target markets?"

📋 TL;DR (Key Findings)

- Regional divergence is real—North America, Latin America, and Europe have fundamentally different AI discovery ecosystems

- ChatGPT dominates North America (72.5% market share) but fragmentation requires multi-engine strategies

- WhatsApp AI leads Latin America—500M+ monthly active users, messaging-first discovery path

- Europe prioritizes trust—72% of enterprises cite data sovereignty; Mistral emerges as regional leader

- One-size-fits-all fails—brands need region-specific content strategies and visibility tracking

- Regulatory impact—EU AI Act is reshaping platform adoption and trust signals in professional content

The Problem: One-Size-Fits-All Doesn't Work

Most organizations approach AI visibility the way they approached SEO a decade ago: build one strategy, deploy it everywhere, and hope for the best.

The assumption is that since ChatGPT and Google AI Overviews are the dominant platforms globally, optimizing for those two engines covers the majority of AI-powered discovery. That assumption is wrong.

Regional data tells a dramatically different story. In Latin America, the fastest-growing AI interface isn't a chatbot or a search engine. It's WhatsApp. In Europe, enterprises are choosing AI platforms based on data sovereignty compliance, not just model capability. In North America, the sheer volume of competing AI tools has created a fragmented landscape where being visible on one engine means little if you're invisible on three others.

A brand running the same AI visibility approach across all three regions isn't being efficient. It's being invisible in at least one of them.

The Context: Why Regional Differences Matter Now

Two forces are accelerating the regional divergence of AI adoption.

Platform Distribution Has Changed

AI is no longer confined to dedicated interfaces. It's embedded inside messaging apps, operating systems, search engines, productivity tools, and social platforms. The channel through which someone encounters an AI-generated answer shapes what content gets surfaced and how. A WhatsApp AI response pulls from different sources and presents information differently than a Perplexity search or a Google AI Overview.

Regulation Is Creating Distinct Market Conditions

The EU AI Act, which began enforcement in 2025, is the most comprehensive AI regulation ever enacted. It doesn't just govern how AI companies operate. It shapes which AI platforms enterprises are willing to adopt, which in turn determines where AI-powered discovery happens for professional audiences.

These forces mean that AI visibility isn't just about content quality or optimization technique. It's about understanding the specific ecosystem of platforms, regulations, and user behaviors that define each market.

The Solution: A Region-by-Region Visibility Strategy

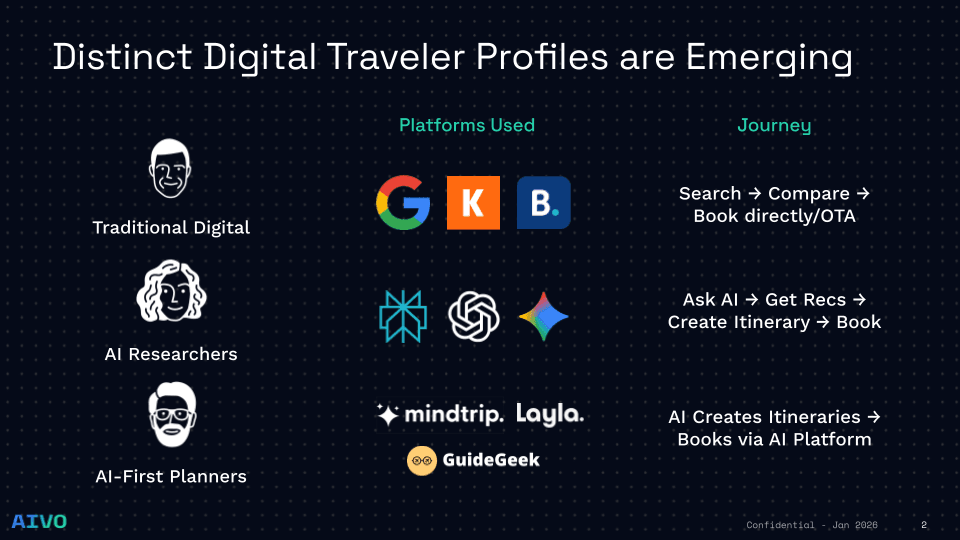

North America: Competing Across a Fragmented Landscape

North America has the highest AI tool penetration in the world, and that creates a unique challenge: fragmentation.

ChatGPT holds approximately 72.5% of the conversational AI market. But Perplexity is growing rapidly among research-oriented users. Google AI Overviews now appear in a significant percentage of search results. Microsoft Copilot is embedded across the Office 365 ecosystem. Each engine surfaces content differently, weighs sources differently, and serves different user intents.

The productivity data adds another layer of complexity. Developer and technical audiences are deep AI users, reporting 20 to 30% productivity improvements through AI coding assistants. But the broader knowledge worker population uses AI at a surface level. A 2025 Microsoft study found that 93% of employees say AI boosts productivity, yet only 47% report quality improvements in their work output.

Strategic implication: In North America, AI visibility requires a multi-engine approach. Brands need to understand how their content performs across ChatGPT, Perplexity, Google AI Overviews, and Copilot simultaneously. AIVO's AI Visibility Intelligence platform helps map this by analyzing visibility across engines rather than treating AI as a monolith. Win/Loss Intelligence becomes critical here because being mentioned in one engine but absent from another is a measurable competitive gap.

Latin America: The Mobile-First, Messaging-First Frontier

Latin America's AI adoption story defies the conventional narrative.

The region didn't follow North America's path of desktop-first AI tools. Instead, AI arrived through a platform that already had universal adoption: WhatsApp. When Meta embedded its AI assistant directly into WhatsApp in 2024, it created an entirely new AI discovery channel.

The scale is staggering. Meta AI now has over 500 million monthly active users globally, with Latin America driving a disproportionate share. Brazil alone has 197 million WhatsApp users. Mexico has over 80 million. Across Colombia, Argentina, and Chile, WhatsApp is the primary communication platform for both personal and business interactions.

This creates a fundamentally different discovery path. In North America, AI discovery happens through intentional search: a user opens ChatGPT or Perplexity with a specific question. In Latin America, AI discovery happens conversationally, embedded within existing messaging flows. Users don't switch to an AI tool. The AI comes to them.

Strategic implication: Brands targeting Latin American markets need to think beyond traditional AI engine optimization. Conversational AI interfaces, mobile-optimized content, and messaging-first strategies are essential. Content that works well in a structured search response may not perform in a WhatsApp conversation. The format, length, and tone need to adapt.

Europe: Where Trust Is the Competitive Advantage

Europe's AI market is being shaped by regulation in a way that has no parallel in other regions.

The EU AI Act classifies AI systems by risk level, mandates transparency for AI-generated content, and imposes significant penalties for non-compliance. For enterprises, this has turned AI platform selection into a compliance decision as much as a technology decision.

Mistral, the French AI company founded in 2023 by former Meta and Google DeepMind researchers, has emerged as Europe's leading sovereign AI provider. Its key differentiator isn't raw model performance. It's the ability to deploy models on European infrastructure with data that never leaves EU borders. According to IDC's 2025 European AI Survey, 72% of EU enterprises now cite data sovereignty as a priority in their AI technology decisions.

This has real implications for visibility. European professional audiences are increasingly using AI platforms that prioritize compliance and transparency. Content that demonstrates regulatory awareness, data handling clarity, and institutional trust signals performs disproportionately well.

Strategic implication: AI visibility in Europe requires understanding the compliance landscape. Brands that position themselves as transparent and regulation-aware will have an advantage in AI-generated recommendations. The content strategy should emphasize trust signals: clear sourcing, data handling statements, and alignment with EU frameworks. AIVO's multi-modal visibility tracking helps identify which compliant engines are surfacing competitor content and where gaps exist.

The Proof: What the Data Shows

The regional differences aren't anecdotal. They're measurable.

| Metric | North America | Latin America | Europe |

|---|---|---|---|

| Dominant AI Interface | ChatGPT (72.5%) | WhatsApp AI (500M+ MAU) | Google AI Overviews + Mistral |

| Primary Discovery Path | Intentional search | Conversational messaging | Compliant search |

| Key Decision Criterion | Capability and speed | Accessibility and integration | Trust and sovereignty |

| Enterprise Priority | Multi-tool productivity | Mobile-first adoption | Data sovereignty (72%) |

| Power User Segment | Developers (20-30% gains) | SMBs on WhatsApp Business | Compliance-focused enterprises |

Brands using AIVO's AI Visibility Intelligence platform can see these patterns in real time. The Win/Loss matrix shows exactly where a brand is being recommended versus where competitors are winning, broken down by engine, query type, and market.

The Action: Build a Regional AI Visibility Strategy

The zero-click reality isn't one reality. It's many. And the brands that recognize this early will have a structural advantage.

Here's where to start:

1. Audit Your Current AI Visibility by Region

Don't assume your global performance reflects your regional performance. A brand that ranks well in ChatGPT may be invisible in WhatsApp AI conversations.

Immediate Actions:

- Test your brand visibility across ChatGPT (North America focus)

- Check WhatsApp AI responses for your category (Latin America focus)

- Query Mistral and Google AI Overviews (Europe focus)

- Document which platforms surface your brand vs. competitors

- Identify complete visibility gaps in specific regions

2. Map the Engine Landscape for Each Target Market

Which AI platforms do your customers actually use? The answer differs dramatically by geography.

Regional Platform Priorities:

- North America: ChatGPT, Perplexity, Google AI Overviews, Microsoft Copilot

- Latin America: WhatsApp AI, ChatGPT mobile, Google AI (Spanish/Portuguese)

- Europe: Google AI Overviews, Mistral, Claude (compliance-focused)

3. Adapt Content Strategy to Regional Discovery Paths

Long-form, data-rich content may win in North American AI engines. Concise, conversational content may perform better in Latin America's messaging-first environment. Trust-signaling content matters most in Europe.

Content Optimization by Region:

North America:

- Comprehensive, multi-section content

- Data-driven analysis with citations

- Platform-specific optimization (different strategies for ChatGPT vs. Perplexity)

- Technical depth for developer audiences

- FAQ and HowTo schema markup

- Mobile-optimized, scannable content

- Conversational tone and shorter responses

- Integration with messaging platforms

- Local language optimization (Spanish/Portuguese)

- Quick-answer format for messaging AI

- Trust signals and compliance language

- Data sovereignty and privacy emphasis

- Clear sourcing and attribution

- Regulatory awareness in content

- EU-specific framework references

4. Measure Continuously

Regional AI landscapes are evolving fast. What works today may shift in six months as platforms update, regulations tighten, and user behaviors change.

Key Metrics by Region:

- Share of Model: How often AI recommends you vs. competitors for category queries (by region and engine)

- Citation Frequency: Number of times AI platforms reference your content (regional breakdown)

- Recommendation Position: Placement in AI responses (1st, 2nd, 3rd recommendation)

- Regional Traffic Patterns: Direct traffic spikes correlated with AI mentions by geography

FAQ

How do I measure regional AI visibility differences?

Start with manual testing across regions: use VPNs to test from different geographic locations, query AI platforms in local languages, and document which platforms show your brand. For systematic tracking, platforms like AIVO automate this across hundreds of queries, multiple AI engines, and different regions. The key metric: visibility rate by region and platform.

Why does North America require a multi-engine approach?

North America has the highest AI tool penetration globally, creating significant fragmentation. ChatGPT has 72.5% market share but that leaves 27.5% across Perplexity, Google AI Overviews, Claude, and Microsoft Copilot. Different user segments prefer different platforms—developers use Copilot heavily, researchers favor Perplexity, general users rely on ChatGPT. Being invisible on even one major engine means missing substantial audience segments.

How does WhatsApp AI in Latin America differ from other AI platforms?

WhatsApp AI is embedded in messaging flows rather than being a separate search destination. Users don't "open an AI tool"—the AI responds within existing conversations. This changes content requirements: answers need to be concise, conversational, and optimized for mobile viewing. Traditional long-form SEO content won't perform well in WhatsApp AI responses.

What makes European AI visibility different from other regions?

The EU AI Act has created a compliance-first market. Enterprises select AI platforms based on data sovereignty, not just capability. This means platforms like Mistral (which keeps data within EU borders) gain preference over US-based alternatives for professional use cases. Content that emphasizes trust, transparency, and regulatory awareness performs better in AI recommendations to European audiences.

Should we create separate content for each region?

Not necessarily separate content, but adapted content. Start with comprehensive base content optimized for North America (where most AI traffic currently originates). Then create regional variations: shorter, more conversational versions for Latin America; trust-signal-heavy versions for Europe. Use hreflang tags and regional targeting to ensure the right content surfaces in each market.

How quickly do regional AI landscapes change?

Regional AI adoption patterns are evolving rapidly. WhatsApp AI launched in 2024; by early 2026 it has 500M+ users. Mistral went from founding in 2023 to becoming Europe's leading sovereign AI provider by 2025. Monitor quarterly at minimum. Major platform updates, regulatory changes, or new entrants can shift regional dynamics within months.

Can smaller companies compete in multiple regional AI markets?

Yes, but prioritize strategically. Start with your primary market and ensure strong visibility there. Then expand to secondary markets based on customer concentration and revenue potential. Regional AI visibility is less resource-intensive than traditional multi-region SEO because the core content can be adapted rather than created from scratch. Focus on platform-specific optimization and local language support.

What if we don't have budget for regional AI strategies?

Start with free auditing: manually test your brand across ChatGPT, WhatsApp AI, and Google AI Overviews in different languages/regions. Identify the biggest gaps. Then prioritize adaptation of existing high-performing content for different regional formats. The cost isn't in creating new content—it's in understanding regional platform differences and optimizing accordingly.

Key Takeaways

Regional Divergence Is Real

- North America = fragmented landscape with ChatGPT dominance (72.5%) but significant Perplexity, Google AI Overviews, and Copilot adoption

- Latin America = messaging-first with WhatsApp AI (500M+ MAU) as primary discovery channel

- Europe = trust and sovereignty-focused with 72% of enterprises prioritizing data compliance; Mistral emergence as regional leader

One-Size-Fits-All Strategies Fail

- Brands optimizing only for ChatGPT miss WhatsApp AI's 500M+ users in Latin America

- Traditional search-optimized content underperforms in conversational messaging environments

- Compliance-light content struggles in European AI platforms where trust signals drive recommendations

Platform Distribution Shapes Strategy

- North America: Multi-engine optimization required (ChatGPT + Perplexity + Google AI Overviews + Copilot)

- Latin America: Mobile-first, conversational content for messaging AI integration

- Europe: Trust-signal emphasis, regulatory awareness, data sovereignty language

Content Must Adapt by Region

- North America: Comprehensive, data-rich, multi-section content with FAQ/HowTo schema

- Latin America: Concise, conversational, mobile-optimized answers for messaging AI

- Europe: Trust signals, clear sourcing, compliance awareness, privacy-forward language

Measurement Must Be Regional

- Share of Model varies dramatically by region—track separately for North America, Latin America, Europe

- Citation frequency differs by platform ecosystem (ChatGPT vs. WhatsApp AI vs. Mistral)

- Traffic attribution requires regional segmentation to understand which AI engines drive results in which markets

Regulatory Impact Is Accelerating

- EU AI Act (enforcement began 2025) reshaping platform adoption across Europe

- Data sovereignty now cited by 72% of EU enterprises as AI selection criterion

- Compliance-first platforms (Mistral) gaining enterprise share over capability-first alternatives

Early Regional Movers Win

- Brands building region-specific AI visibility strategies now are establishing compounding advantages

- AI models learn from current citations—regional dominance builds over time

- First movers in Latin America's WhatsApp AI and Europe's sovereign platforms are training AI associations

The Bottom Line

The global AI visibility strategy is a myth. Brands must understand and optimize for distinct regional ecosystems. North America requires multi-engine strategies. Latin America demands messaging-first optimization. Europe prioritizes trust and compliance. The brands that adapt win. The ones that don't wonder why their global numbers keep declining.

---

Regional AI Visibility Snapshot

Get your free AI Visibility Snapshot and see exactly how your brand performs across engines and regions—ChatGPT, WhatsApp AI, Perplexity, Google AI Overviews, and Mistral. Takes 2 minutes. No credit card required.

Get Your Free Regional Analysis: tryaivo.com/snapshot

Questions about regional AI visibility strategy? Email team@tryaivo.com

---

Sources & References

- ChatGPT Market Share [Source: Similarweb, Statista 2025-2026]

- Meta AI Monthly Active Users [Source: Meta Q4 2025 Earnings Report]

- WhatsApp Regional Users [Source: Statista 2025 - Brazil (197M), Mexico (80M+)]

- Microsoft Work Trend Index [Source: Microsoft 2025 - 93% productivity boost, 47% quality improvement]

- Developer AI Productivity [Source: GitHub Copilot Studies, McKinsey 2025 - 20-30% productivity gains]

- EU Enterprise Data Sovereignty [Source: IDC European AI Survey 2025 - 72% prioritize data sovereignty]

- EU AI Act [Source: European Commission - Enforcement began 2025]

- Mistral AI [Source: Company information, EU AI industry analysis 2025]

Related Articles:

- The AI Visibility Gap 2026 - Why 92% of marketers see the shift but only 23% know what to do

- SEO Isn't Dead. But It's Not Fine Either - Understanding the structural shift in organic traffic

- How AI Engines Decide What to Cite - Claude, ChatGPT, and Perplexity backend infrastructure explained

Author: Sebastian Pinzon is Co-Founder of AIVO, an AI Visibility Intelligence Platform helping global brands optimize for Share of Model across ChatGPT, Perplexity, Google AI Overviews, WhatsApp AI, and regional AI platforms. With 15+ years of experience at major agency holding companies (Publicis, WPP, OMG), he's now focused on helping brands navigate regional AI discovery landscapes.

Connect on LinkedIn | tryaivo.com