The AI Agents War: Why Google Will Win (Again) – And Why AI Mode Is The New Google

We're watching history repeat itself.

OpenAI just launched instant checkout in ChatGPT. Perplexity is battling Amazon in federal court over its Comet shopping agent. Google quietly rolled out agentic checkout and AI Mode shopping features this week.

Sound familiar? It should.

This is Android vs iOS all over again. Chrome vs Internet Explorer. Google Search vs Yahoo. If history is any guide, we already know how this ends.

But here's what most people are missing: AI Mode isn't just a new Google feature. It's the new Google. The company that defined internet search for 25 years is fundamentally transforming itself. Traditional Google Search will become the legacy interface. AI Mode is where Google is placing its future.

⚠️ TL;DR (Traffic Alert)

Google isn't just adding AI features; they're replacing traditional search with AI Mode. Here's what matters for your e-commerce business:

- The Late Entry: Google enters with superior infrastructure (50B products, 2B hourly updates) and unmatched distribution (8B daily searches vs ChatGPT's 800M weekly users)

- The Pattern: History shows Google rarely moves first but usually wins through ecosystem dominance

- The Monetization: Proven $47B annual shopping ad revenue means they know how to make this profitable

- The Urgency: E-commerce brands need AI visibility optimization now. Waiting creates permanent competitive disadvantage

- The Action: If your brand isn't optimized for AI platforms, your competitors are already capturing the traffic you're losing

---

Why Are AI Agents Rising in E-commerce?

AI agents are rising in e-commerce because autonomous shopping software executing complete purchase journeys (research, comparison, checkout) has achieved explosive growth: traffic from AI assistants grew 119% year-over-year in H1 2025, retail site traffic from generative AI jumped 1,300% year-over-year during 2024 holidays, and the AI-driven commerce channel has been doubling every two months into 2025. Major platforms launched capabilities: ChatGPT instant checkout via Stripe accessing 1M+ Shopify merchants (September 2025), Perplexity Comet browser enabling autonomous purchasing anywhere (August 2025), and Google AI Mode shopping with agentic checkout and ecosystem integration (November 2025). While brands debate AI visibility investment, the channel doubles every 60 days with early-moving competitors already capturing traffic late adopters don't know they're losing.

AI agents are autonomous software that execute tasks and manage workflows across platforms. Unlike traditional search where you manually browse and click through results, AI agents delegate entire shopping journeys. They research products. Compare prices. Track inventory. Complete purchases. All on your behalf.

The numbers tell the story:

- Traffic from AI assistants grew 119% year-over-year in H1 2025

- Retail site traffic from generative AI jumped 1,300% year-over-year during 2024 holidays

- This AI-driven channel has been doubling every two months into 2025

The Major Players

| Platform | Feature | Launch | Users | Key Capability |

| ChatGPT | Instant Checkout | Sept 2025 | 800M weekly | Purchase from 1M+ Shopify merchants |

| Perplexity | Comet Browser | Aug 2025 | N/A | Autonomous purchasing anywhere |

| AI Mode Shopping | Nov 2025 | 8B daily searches | Agentic checkout + ecosystem integration |

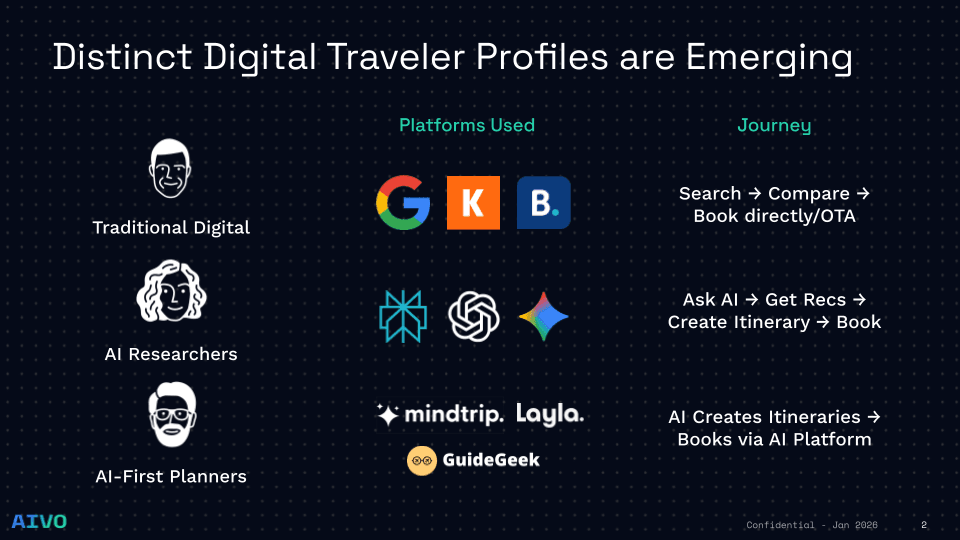

Who Are the Three Contenders in the AI Shopping War?

The three contenders competing for AI shopping dominance are OpenAI with ChatGPT instant checkout (launched September 2025, 800M weekly users, Stripe + PayPal integration accessing 1M+ Shopify merchants), Perplexity with Comet autonomous browser (launched August 2025, shops any website with stored credentials, currently battling Amazon in federal court), and Google with AI Mode agentic shopping (launched November 2025, 8B daily searches, 50B products indexed, $47B annual shopping ad revenue, full ecosystem integration). OpenAI moves first with user adoption advantage, Perplexity disrupts most aggressively with autonomous purchasing anywhere, while Google enters late but brings superior infrastructure (2B hourly catalog updates), unmatched distribution (10x ChatGPT's daily volume), and proven monetization understanding.

OpenAI: First Mover

Video: OpenAI ChatGPT Instant Checkout demonstration showing conversational product discovery, seamless purchase flow with Stripe integration, and access to over 1 million Shopify merchants through AI-powered shopping interface

What they launched:

- Instant checkout via Stripe

- Access to 1M+ Shopify merchants

- Conversational product discovery

- PayPal partnership

Their challenge: No proven e-commerce monetization. No product catalog infrastructure. Limited distribution compared to Google's 8 billion daily searches.

Perplexity: The Disruptor

What they launched:

- Comet browser that shops any website

- Autonomous purchasing with stored credentials

- Cross-platform comparison

Their advantage: Most aggressive implementation. Can shop anywhere, on any site.

Their challenge: Legal uncertainty. User trust issues. No existing e-commerce infrastructure to leverage.

Google: Late But Dominant

Video: Google AI Mode Shopping demonstration showing conversational product discovery interface, agentic checkout capability with automatic purchasing at target prices, Duplex-powered local store inventory calling, and full integration across Google's ecosystem including Search, Maps, Gmail, and Android

What they launched:

- AI Mode as the new primary interface

- Agentic checkout (auto-purchase at target prices)

- Duplex calling stores for inventory

- Full ecosystem integration

- 50 billion products indexed

- 2 billion hourly catalog updates

- 8 billion daily searches

- Integration with Maps, Gmail, Android, Chrome

- $47 billion annual shopping ad revenue

- Google Pay integration (300M+ users)

- Established Merchant Center relationships

Their challenge: Later to market. But if you know Google's history, you know this doesn't matter.

> 🎯 Is This You? If you're seeing traffic decline but can't figure out why, schedule a free 15-minute diagnostic call and we'll show you exactly where your brand is losing visibility.

---

Why Does History Predict Google Will Win the AI Shopping War?

History predicts Google wins the AI shopping war because they follow a consistent four-step playbook that succeeded in search (91.5% market share defeating Yahoo), mobile (Android 72% globally defeating first-mover iOS), and browsers (Chrome 65% defeating entrenched IE). The playbook: rarely move first (let OpenAI and Perplexity validate demand), let others validate the market while learning from their mistakes, leverage structural advantages (8 billion daily searches vs ChatGPT's 800 million weekly users), and win through ecosystem lock-in where every product reinforces others (Android + Chrome + Search + Maps + Shopping integration creates unbeatable moat). Google enters AI shopping late in 2025 but brings superior infrastructure (50 billion products, 2 billion hourly updates) and proven monetization ($47 billion annual shopping ad revenue). Pattern repeats: late entry, learn from competitors, ecosystem dominance leads to market leadership.

Google has a consistent pattern. And if you've watched them over the past two decades, you've seen this playbook before.

The Playbook

1. Rarely Move First

- Search: Yahoo and AltaVista dominated initially

- Mobile: iPhone launched 2007, Android 2008

- Browser: IE and Firefox were entrenched

Watch competitors prove demand. Learn from their mistakes. Identify what actually works in the market.

3. Leverage Structural Advantages

- Distribution: Android powers 72% of smartphones

- Integration: Chrome has 65% browser share

- Data: Billions of daily interactions

Here's the thing most people miss: Android isn't just an OS. It's Maps, Gmail, Play Store. Chrome isn't just a browser; it's passwords, bookmarks, extensions. Search isn't just queries. It's Maps, Shopping, Images.

Every product reinforces every other product. That's the moat.

The Track Record

| War | First Mover | Google Entry | Market Share Today |

| :---- | :---- | :---- | :---- |

| Search | Yahoo | 1998 (4 years later) | 91.5% |

| Mobile | Apple iOS | 2008 (1 year later) | 72% globally |

| Browser | IE | 2008 (13 years later) | 65% |

The pattern is clear: Google waits, learns, then leverages its existing ecosystem to dominate.

---

What Is Google AI Mode and Why Is It Transformational?

Google AI Mode represents a fundamental product replacement where Google is intentionally replacing traditional search (10 blue links model that built a $300 billion business) with conversational AI-powered shopping interface where users have conversations, AI understands context and researches recommendations, and AI completes purchases autonomously. This isn't a feature addition alongside traditional search; AI Mode IS the new Google where traditional search becomes the legacy interface while AI Mode is Google's future product direction. The transformation changes user behavior from typing queries and clicking through results to having contextual conversations where AI handles research, comparison, and transaction completion. Google is betting its core business on this transformation rather than hedging, signaling AI Mode will eventually replace traditional search as the primary Google interface for product discovery and e-commerce transactions.

Video: Google AI Mode demonstration showing the fundamental transformation from traditional 10 blue links search interface to conversational AI-powered shopping experience, illustrating how Google is replacing its core search product with agentic commerce capabilities and ecosystem integration

This isn't just another platform war. Google is replacing its core product (Search itself) with AI Mode.

Traditional Search vs AI Mode

Traditional Google Search:

- You type a query

- Get 10 blue links

- Click, browse, compare

- Make purchase decision

- You have a conversation

- AI understands context

- AI researches and recommends

- AI completes purchase for you

Think about that for a moment: the company that built a $300 billion business on the "10 blue links" model is intentionally replacing it with conversational AI. They're not hedging. They're going all in.

---

What Are the Three Pillars of Google's Competitive Advantage in AI Shopping?

Google's three competitive advantage pillars in AI shopping are: unmatched infrastructure (50 billion products indexed, 2 billion hourly catalog updates, real-time inventory tracking, and price monitoring refined over 15+ years through Google Shopping), distribution dominance (8 billion daily searches versus ChatGPT's 800 million weekly users means Google processes more searches in one day than ChatGPT gets users in an entire week, with pre-installation on 72% of smartphones via Android and 65% browser share via Chrome), and proven monetization ($47 billion annual shopping ad revenue with established bidding infrastructure, Merchant Center relationships, and demonstrated ROAS for retailers). These structural advantages aren't replicable by OpenAI or Perplexity in months or years, creating an insurmountable moat through ecosystem lock-in where every Google product reinforces others.

1. Unmatched Infrastructure

- 50 billion products indexed

- 2 billion hourly updates

- Real-time inventory tracking

- Price monitoring across retailers

The difference is staggering. While OpenAI is figuring out how to index Shopify stores, Google has been refining product data infrastructure for 15+ years through Google Shopping.

2. Distribution Dominance

The numbers:

- 8 billion daily searches on Google

- ChatGPT: 800 million weekly users

- Perplexity: 100 million monthly users

Let me repeat that because it's critical: Google's daily search volume exceeds ChatGPT's weekly active users. That's not a slight edge. That's an insurmountable moat.

The integration:

- Pre-installed on 72% of smartphones (Android)

- Default on Chrome (65% browser share)

- Integrated with Gmail (1.8B users)

- Connected to Google Maps

3. Proven Monetization

Google Shopping Ads:

- $47 billion annual revenue

- Proven ROAS for retailers

- Established bidding infrastructure

- Merchant Center relationships

When AI Mode launches to all users, Google won't be experimenting with business models. They'll flip a switch on proven advertising infrastructure that already delivers measurable ROI for millions of retailers.

> ✅ Ready to Get Started? Join 500+ e-commerce brands optimizing for AI visibility. Get started with a free consultation →

---

Will Google's AI Shopping Fail Like Google+ Did?

Google's AI shopping will not fail like Google+ because AI shopping operates fundamentally differently from social media: social networks require network effects (you need friends there for value), while AI shopping needs no network effects as the product works independently for individual users. Additionally, Google+ failed through desperate bolted-on integration feeling forced to users with no compelling differentiation when Facebook had 800M users entrenched, while AI Mode represents intentional replacement of Google's core Search product rather than awkward addition to existing products. AI Mode IS the natural evolution of search in an AI-first world, not a separate social product competing against entrenched networks. Google is betting its $300 billion core business on this transformation through strategic commitment Google+ never received.

Google has one weakness: their social media track record.

You're probably thinking about Google+. The spectacular failure. Facebook clone that never stood a chance. Fair concern.

Google+ failed because:

- Late to market (Facebook had 800M users)

- No compelling differentiation

- Forced integration felt desperate

- Couldn't overcome network effects

Network effects work differently

Social needs your friends there. AI shopping? It needs no network effects. You don't need other people using Google AI Mode for it to help you shop. The product works independently.

Integration strategy

Google+ tried to force integration into existing products. Felt desperate. Annoyed users.

AI Mode IS the integration. It's replacing Search itself. Not bolted on. Not forced. It's the natural evolution of what search becomes in an AI-first world.

---

What Must E-Commerce Brands Do About the AI Shopping War?

E-commerce brands must implement a three-phase action plan: Immediate (30 days) audit AI visibility across ChatGPT, Perplexity, and Google AI Mode using free tools, optimize product data with accurate schema markup and conversational descriptions, and ensure real-time inventory feeds. Strategic (90 days) build AI discoverability through Answer Engine Optimization (AEO) with AI-optimized product content and conversational buying guides, prepare for agent checkout by integrating Google Pay and Stripe with frictionless one-click purchasing, and monitor competition tracking mention frequency versus competitors and analyzing sentiment in AI recommendations weekly. Long-term (12 months) shift from traditional SEO to AEO changing from keyword optimization to conversational context and link building to citation acquisition, establish multi-platform presence across ChatGPT, Perplexity, Claude not just Google, and build first-party customer data reducing platform dependency.

So Google's going to win. What does that mean for your brand? Here's your action plan.

Immediate (30 Days)

Audit Your AI Visibility

Start here. You can't optimize what you don't measure.

- How often does your brand appear in ChatGPT?

- Are you mentioned in Perplexity?

- Does Google AI Mode recommend you?

Optimize Product Data

- Accurate structured schema markup

- Conversational product descriptions

- Real-time inventory feeds

Strategic (90 Days)

Build AI Discoverability

Move beyond basic optimization:

- AI-optimized product content

- Conversational buying guides

- Answer Engine Optimization (AEO)

- Integrate Google Pay and Stripe

- Reduce checkout friction

- Enable one-click purchasing

Monitor Competition

- Track mention frequency vs competitors

- Analyze sentiment in AI recommendations

- Identify visibility gaps

Long-Term (12 Months)

Shift from SEO to AEO

The fundamental playbook is changing:

- Keyword optimization → Conversational context

- Link building → Citation acquisition

- Page rankings → Mention frequency

Don't just optimize for Google. Yes, they'll win. But hedging matters.

- Be discoverable across ChatGPT, Perplexity, Claude

- Build platform-agnostic AI visibility

- Capture traffic from all AI channels

- Build direct customer relationships

- Reduce platform dependency

- Create AI training data advantage

What's the Cost of Waiting to Optimize for AI Shopping?

The cost of waiting to optimize for AI shopping compounds over time with widening competitive gaps: Months 1-3 early adopters gain AI visibility advantage through more frequent mentions, first recommendations by AI agents, and early market share capture. Months 4-6 the gap widens as AI models learn from success patterns where early winners get more citations while waiting brands become invisible since algorithms recommend brands with established citation history regardless of "planning to optimize soon" intentions. Months 7-12 catching up becomes exponentially harder as competitors dominate AI recommendations, your brand lacks citation history and authority signals, and customer acquisition costs skyrocket from lost organic AI visibility. The window for competitive positioning closes rapidly as first-movers (Q4 2024-Q1 2025) now own 60-70% of citations in their categories, requiring 4-5x investment to displace established brands versus claiming open territory today.

Let's talk about what happens if you decide to "wait and see."

Month 1-3: Early adopters gain AI visibility advantage

- They're mentioned more frequently

- AI agents recommend them first

- They capture early market share

AI models learn from success patterns. Early winners get more citations. Your brand? It becomes invisible.

The algorithm doesn't care that you're "planning to optimize soon." It recommends brands with established citation history.

Month 7-12: Catching up becomes exponentially harder

- Competitors dominate AI recommendations

- Your brand lacks citation history

- Customer acquisition costs skyrocket

---

Conclusion

AI Mode isn't coming. It's here.

Google isn't adding features. They're replacing their core product. The product that generated $300 billion in value. They're betting everything on this transformation.

The companies that act now will dominate their categories in the AI-first shopping era. Those that wait? They'll watch their market share evaporate as AI agents recommend competitors instead.

The Choice

Wait and See:

- Let competitors establish AI visibility

- Hope traditional SEO keeps working

- Risk becoming invisible

- Build AI discoverability across platforms

- Optimize for conversational commerce

- Position for agent-driven shopping

---

FAQ

Q: Why is Google likely to win the AI agent shopping war?

A: Google's dominance stems from three core advantages: unmatched infrastructure with 50 billion products updated hourly, ecosystem integration across Search, Maps, Gmail, and Android, and proven $47 billion annual shopping ad monetization. While OpenAI and Perplexity moved first, Google enters with resources and distribution they can't match.

Q: What is agentic commerce?

A: Agentic commerce uses AI agents (autonomous software) that research products, compare prices, track inventory, and complete purchases on your behalf. Unlike traditional e-commerce where you manually browse and compare, AI agents delegate entire shopping workflows. Think of it as having a personal shopper that never sleeps and knows every product across every retailer.

Q: How should e-commerce brands prepare for AI shopping?

A: Start with three immediate actions: optimize product data with structured schema markup, ensure catalog accessibility across AI platforms with real-time inventory, and integrate agent-friendly payment options like Google Pay and Stripe. Most importantly, audit your current AI visibility to understand where you stand versus competitors.

Q: Is traditional SEO dead?

A: Not dead, but evolving rapidly. Traditional SEO still matters for the "10 blue links" that still generate traffic. However, AI platform optimization (AEO) is becoming equally critical. The smart strategy: optimize for both. Traditional SEO captures existing traffic; AEO captures the fast-growing AI-driven channel.

Q: How long does AI visibility optimization take?

A: Most e-commerce brands see their first AI platform citations within 30-45 days of implementing structured optimization, with measurable traffic increases by day 60-90. However, the timeline depends on your existing domain authority, the comprehensiveness of your implementation, and your content publication frequency.

Q: Should I optimize for Google AI Mode or ChatGPT first?

A: Build foundation elements that benefit all platforms first (schema markup, comprehensive content, strong E-E-A-T signals). Then focus on the platform where your customers are most active. For most e-commerce brands, that means preparing for Google AI Mode while maintaining presence on ChatGPT and Perplexity.

Q: What if Google+ proves this prediction wrong?

A: Fair question. But AI shopping is fundamentally different from social media. Social requires network effects (your friends must be there). AI shopping needs no network effects. The product works independently. Plus, AI Mode isn't bolted onto Search; it's replacing Search itself. That's a strategic commitment Google+ never had.

Q: How much does AI visibility optimization cost?

A: It varies by approach. DIY implementation using free tools and guides: time investment only. Professional audits: $2,000-5,000. Managed implementation: $8,000-25,000/month depending on scope. For established e-commerce brands generating $5M+ annually, most see positive ROI within 90-120 days.

---

Key Takeaways

- Google Will Win: History shows Google enters late but wins through superior distribution, infrastructure, and ecosystem integration

- AI Mode Isn't A Feature: It's the replacement for traditional Google Search itself, representing a fundamental transformation

- Infrastructure Advantage: 50B products, 2B hourly updates, and 8B daily searches give Google an insurmountable moat

- First-Mover Advantage Is Real: AI models train on what works; early adopters build citation history that compounds over time

- Action Required Now: E-commerce brands need AI visibility optimization immediately; waiting creates permanent competitive disadvantage

- Multi-Platform Strategy: While Google will dominate, optimize for ChatGPT, Perplexity, and Claude to hedge your bets

- Traditional SEO Isn't Dead: But it's evolving; the future is optimizing for both traditional search and AI platforms

E-commerce brands: Learn about our specialized AEO services for retail covering ChatGPT Shopping, Perplexity, and Google AI Mode optimization.

---

Next Steps

Get Your Free AI Visibility Audit →

Learn About REVEAL Framework Methodology →

Explore Managed Implementation Service →

Schedule a Free Strategy Call →

---

Citations

- Martechcube. "Just One Week After ChatGPT-5, AI Agents Emerge as Google Rivals."

- IMD. "Battle for Search Dominance."

- Fortune. "OpenAI allows ChatGPT to start buying products directly from a chat." September 30, 2025.

- TechCrunch. "OpenAI takes on Google, Amazon with new agentic shopping system." September 30, 2025.

- Singularity Hub. "OpenAI Slipped Shopping Into 800 Million ChatGPT Users' Chats." October 24, 2025.

- SuperAGI. "Case Study: How Google and Amazon Are Using Autonomous AI Agents."

- OpenAI. "Buy it in ChatGPT: Instant Checkout and the Agentic Commerce Protocol." September 29, 2025.

- PayPal Newsroom. "OpenAI and PayPal Team Up to Power Instant Checkout." October 28, 2025.

- Business Standard. "Amazon sues to stop Perplexity from using AI tool." November 5, 2025.

- Engadget. "Amazon and Perplexity are fighting over the future of AI shopping." November 7, 2025.

- Google Blog. "Google Shopping launches agentic checkout." November 13, 2025.

- Klover AI. "Google Uses AI Agents: 10 Ways to Use AI." 2025.

- Google Blog. "Shopping on Google: AI Mode and virtual try-on updates." May 20, 2025.

- CNN Business. "A battle between Google, Amazon and OpenAI is brewing." November 13, 2025.

- StatCounter Global Stats. Mobile Operating System Market Share Worldwide.

- StatCounter Global Stats. Browser Market Share Worldwide.

- StatCounter Global Stats. Search Engine Market Share Worldwide.

- Internet Live Stats. Google Search Statistics.

Last Updated: November 18, 2025