Updated: November 2025

E-commerce AI Visibility: ChatGPT Shopping vs Perplexity vs Amazon Rufus Platform Priorities

53% of shoppers now use AI tools for product research. Traffic from AI shopping assistants grew 1,950% year-over-year on Cyber Monday 2024. Amazon Rufus handles 13.7% of Amazon searches (274 million daily queries).

The question isn't whether to optimize for AI shopping platforms. It's which platforms to prioritize first.

📋 TL;DR (For E-commerce Decision-Makers)

The Three Platforms:

- ChatGPT Shopping: Highest consumer adoption (53% shoppers), 1 billion weekly searches, instant Shopify checkout, broad categories

- Perplexity Shopping: Research-focused (15M monthly users), desktop-heavy (59.7% U.S.), higher conversion, citation transparency

- Amazon Rufus: On-Amazon only (13.7% of Amazon searches), $10B sales trajectory, 60% higher purchase likelihood

- AI shopping traffic grew 1,300-1,950% YoY (Adobe, 2024-2025)

- AI-referred shoppers show 8% higher engagement, browse 12% more pages, 23% lower bounce rate

- 58% of consumers now use AI for product research before traditional search

- Fashion/Beauty: ChatGPT first, Perplexity second, Rufus third

- Electronics/Tech: Perplexity first, ChatGPT second, Rufus for Amazon sellers

- Home Goods: ChatGPT first, Rufus second (Amazon dominance), Perplexity third

- Specialty/Niche: Perplexity first (research-heavy), ChatGPT second

> ⚡ Quick Check: See where your products appear across AI platforms now. Run free AI visibility audit (60 seconds)

---

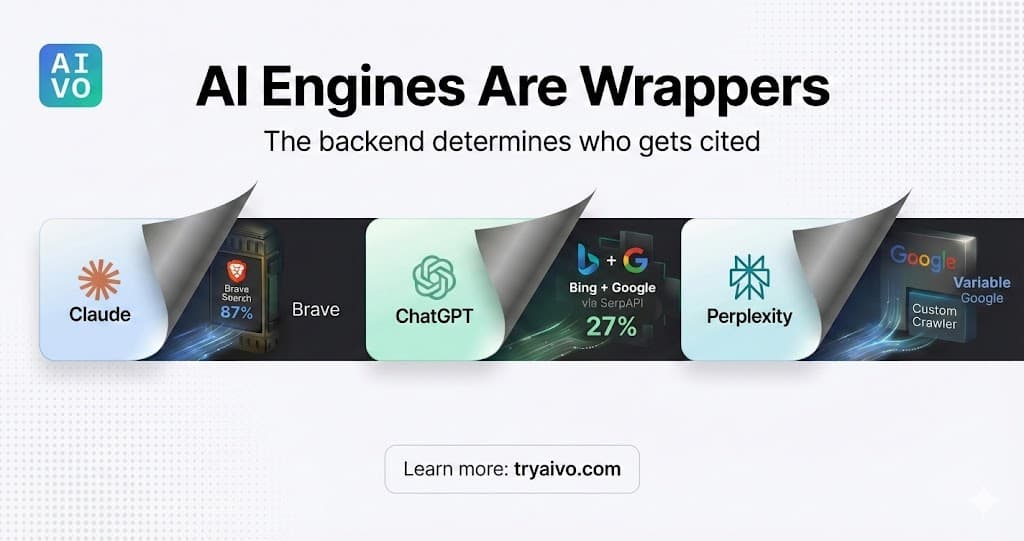

What Are the Three Major AI Shopping Platforms?

The three major AI shopping platforms competing for e-commerce discovery are ChatGPT Shopping (launched April 2025 with 1 billion weekly searches, instant checkout via Agentic Commerce Protocol and Stripe, accessing 1M+ Shopify merchants including Glossier, SKIMS, Spanx with organic unsponsored product rankings), Perplexity Shopping (15 million monthly active users, 100+ million weekly queries, research-oriented shoppers, Snap to Shop visual search, direct checkout with select partners), and Amazon Rufus (13.7% of Amazon's 2 billion daily searches equaling 274 million daily Rufus queries, on-Amazon shopping assistant only, on pace for $10 billion incremental annual sales, users 60% more likely to purchase). ChatGPT dominates broad consumer adoption, Perplexity targets research-intensive purchases, Amazon Rufus serves exclusively on-Amazon discovery without off-Amazon product recommendations.

Let's establish what you're actually choosing between.

ChatGPT Shopping

Launch: April-September 2025 (shopping features rolled out, Instant Checkout September 2025)

Reach:

- 1 billion weekly searches across ChatGPT (not all shopping, but massive base)

- 400+ million weekly active users

- 53% of U.S. shoppers use AI tools (ChatGPT largest share)

- Users ask conversational queries: "best noise-cancelling headphones under $150"

- ChatGPT displays product cards (images, prices, reviews, specs)

- Organic rankings (not sponsored, ranked by relevance only)

- Instant Checkout via Shopify integration (U.S. Etsy sellers live, 1M+ Shopify merchants coming)

- Otherwise redirects to merchant site for purchase

Merchant Access:

- Shopify merchants: Automatic via Checkout Kit integration

- Other merchants: Can apply for integration

- Product feeds via API connections

---

Perplexity Shopping

Launch: Ongoing evolution (shopping features integrated 2024-2025)

Reach:

- 15 million monthly active users

- 100+ million weekly queries

- 159.7 million monthly visits (March 2025, +191.9% YoY growth)

- Users conduct research queries with shopping intent

- Perplexity displays answers with explicit citations and source links

- "Snap to Shop" visual search capability

- Direct checkout with select merchant partners (expanding)

- Heavy integration of product images, comparison charts, specifications

User Behavior:

- Desktop-heavy: 59.7% of U.S. users on desktop (vs 36.47% globally)

- Average session: 23 minutes 10 seconds (research-intensive)

- 4.64 pages per visit (deep exploration)

- 42.19% bounce rate (moderate, users often compare multiple sources)

- Product feeds via BigCommerce/Feedonomics partnerships

- Direct API integration available

- Merchant Hub for product catalog management

---

Amazon Rufus

Launch: Beta 2024, full U.S. rollout September 2024

Reach:

- 13.7% of Amazon searches (October 2024, ~274 million daily queries)

- Projected 25-35% of Amazon searches by end 2025

- 250 million+ customers used Rufus in 2025

- Integrated into Amazon search bar and app

- Users ask conversational questions about Amazon products

- Rufus answers from Amazon catalog, Q&As, reviews

- On-Amazon only (doesn't recommend off-Amazon products)

- Seamless purchase within Amazon ecosystem

Commercial Impact:

- Rufus users 60% more likely to purchase

- On pace for $10 billion incremental annual sales

- Conversion advantage through integration with Amazon's purchase infrastructure

- All Amazon sellers automatically included

- Optimization through listing content (bullets, descriptions, A+ content, FAQs, reviews)

- No separate integration required

---

How Do Consumer Adoption Rates Compare?

Consumer adoption rates show ChatGPT Shopping leading overall adoption (53% of U.S. shoppers use AI tools with ChatGPT commanding largest share, traffic from AI assistants grew 1,300% YoY November-December 2024 and 1,950% on Cyber Monday), Perplexity growing rapidly among research-intensive buyers (15 million monthly active users, +191.9% YoY visitor growth, users spend average 23 minutes per session indicating deep product research), and Amazon Rufus achieving massive on-Amazon penetration (13.7% of Amazon's 2 billion daily searches equals 274 million daily Rufus queries, projected 25-35% of Amazon searches by end 2025). Demographic patterns: Millennials lead adoption at 46% with higher-income Millennials ($70K+) exceeding 50%, Gen Z at 40% using TikTok/Instagram alongside AI tools, and Baby Boomers showing rapid growth (+63% September 2024 to February 2025). Overall: 58% of consumers now use Answer Engines for product research, with 79.7% relying on AI for at least half of decision-making process.

Here's who's actually using these platforms and how adoption is growing.

Overall AI Shopping Adoption

Adobe Survey Data (5,000 U.S. consumers, February 2025):

- 53% use AI tools (Amazon Rufus, ChatGPT, Perplexity) for online shopping

- 47% use specifically for product recommendations

- 35% for gift ideas

- 35% for finding unique products

- 58% of consumers use Answer Engines weekly

- 79.7% rely on AI for at least half of purchase decision-making

- 70% ultimately buy something after AI research

- Traffic from AI shopping assistants doubled every 2 months (September 2024-February 2025)

- 1,300% YoY increase in AI referral traffic to retail sites (Nov-Dec 2024)

- 1,950% YoY spike on Cyber Monday 2024

- February 2025: 1,200% increase vs July 2024

ChatGPT Shopping Adoption

User Base:

- 400+ million weekly active users (total ChatGPT)

- 1 billion weekly searches conducted

- 53% shopper adoption means ~210 million shoppers using AI tools (ChatGPT largest component)

- Instant Checkout launched September 2025 (U.S. Etsy live, 1M+ Shopify merchants coming)

- Categories: Fashion, beauty, electronics, home goods

- Adoption accelerating as checkout integration expands

- 8% higher engagement than non-AI traffic

- 12% more pages viewed per visit

- 23% lower bounce rate

- 41% longer visit duration

Perplexity Shopping Adoption

User Base:

- 15 million monthly active users (overall Perplexity)

- 100+ million weekly queries

- 159.7 million monthly visits (March 2025)

- +191.9% YoY visitor growth (March 2024: 52.4M → March 2025: 159.7M)

- 71% month-over-month referral growth (higher than ChatGPT's 44%)

- Average session: 23 minutes 10 seconds (deep research)

- 4.64 pages per visit (thorough comparison)

- 42.19% bounce rate

- Desktop dominant: 59.7% U.S. users (vs 36.47% global average)

---

Amazon Rufus Adoption

Usage Statistics:

- 13.7% of Amazon searches (October 2024)

- Amazon processes 2 billion searches daily

- Rufus: ~274 million daily queries

- Projected: 25-35% of Amazon searches by end 2025

- 250+ million customers used Rufus in 2025

- 60% more likely to purchase (Rufus users vs non-Rufus)

- On pace for $10 billion incremental annual sales

---

Demographic Breakdown

By Age (Adobe survey):

- Millennials: 46% adoption (+12% expect to adopt by year-end)

- Higher-income Millennials ($70K+): 50%+ adoption

- Gen Z: ~40% adoption

- Baby Boomers: Lowest but growing (+63% September 2024 to February 2025)

- Large/complex purchases (electronics, appliances): 87% more likely to use AI

- Research-intensive categories: 60%+ AI usage

- Quick purchases (grocery, apparel basics): Lower AI usage

- Entertainment/Media: 44%

- Clothing: 41%

- Health/Beauty: 34%

- Home decor/furnishings: Women-skewed

- Gaming/tech: Male-skewed

What Are the Platform-Specific Strengths and Limitations?

Platform-specific strengths and limitations reveal ChatGPT Shopping excels at broad category coverage (fashion, beauty, electronics, home goods all strong), conversational discovery (users ask natural questions, not keyword searches), and ecosystem reach (1 billion weekly searches creating massive discovery potential) but limited by redirect-to-purchase for non-Shopify merchants and no Amazon product access. Perplexity Shopping excels at research-intensive purchases (electronics, tech requiring specification comparison), desktop research behavior (59.7% U.S. desktop vs 36.47% global indicating serious shoppers), citation transparency (explicit source links driving qualified traffic), and higher-intent conversion but limited by smaller user base (15M monthly vs ChatGPT's 400M+ weekly) and desktop-heavy reducing mobile shopping convenience. Amazon Rufus excels at on-Amazon conversion (60% higher purchase likelihood through native integration), massive query volume (274M daily), and full Amazon ecosystem access but cannot recommend off-Amazon products making it irrelevant for DTC brands not selling on Amazon marketplace.

Let's compare what each platform does well and where they fall short.

ChatGPT Shopping: Broad Reach, Growing Integration

Strengths:

1. Massive User Base

- 1 billion weekly searches across ChatGPT

- 53% of shoppers using AI tools (ChatGPT leading share)

- Broad demographic reach across ages and categories

- Natural language queries: "gifts for a ceramics lover under $50"

- Follow-up refinement: "Show me something more colorful"

- User preference memory across sessions

- No sponsored placements (yet)

- Rankings based purely on relevance

- Level playing field for smaller merchants vs major brands

- Instant Checkout via Agentic Commerce Protocol

- 1M+ Shopify merchants gaining direct checkout access

- Maintains merchant as merchant of record (direct customer relationship)

- Shows products across Amazon, Walmart, independent merchants

- Price comparison across retailers

- Availability checking

1. Redirect-to-Purchase (Most Merchants)

- Only Shopify/Etsy have Instant Checkout currently

- Others require leaving ChatGPT to complete purchase (friction point)

- Conversion loss during redirect

- Doesn't access all merchant inventories (relies on API integrations)

- Real-time inventory accuracy varies

- Some categories underserved

- Cannot recommend Amazon products directly

- Misses 40-50% of e-commerce market

- Forces users to second platform for Amazon shopping

- Desktop-first design currently

- Mobile shopping integration improving but not optimized

Perplexity Shopping: Research Quality Over Volume

Strengths:

1. Research-Oriented Users

- Average 23-minute sessions (vs typical 2-3 minutes e-commerce browsing)

- 4.64 pages per visit (deep exploration)

- Desktop-heavy (serious research behavior)

- Explicit source links ("Read more" citations)

- Users can verify information

- Drives qualified referral traffic to merchant sites

- Users researching thoroughly before purchase

- AI-referred traffic from Perplexity often converts higher than ChatGPT

- Lower bounce rates on merchant sites (already educated)

- Excels at technical product comparisons

- Data-driven recommendations

- Visual search capability ("Snap to Shop")

- BigCommerce/Feedonomics integration

- Merchant Hub for product catalog

- Expanding partnerships

1. Smaller User Base

- 15M monthly vs ChatGPT's 400M+ weekly

- Limited absolute traffic volume potential

- 59.7% U.S. desktop users

- Mobile shopping less convenient

- Misses impulse mobile purchases

- Users research on Perplexity, often buy elsewhere (Amazon, Google Shopping)

- Attribution challenges (researched here, purchased there)

- Citation doesn't always = conversion

- Strong in tech/electronics, weaker in fashion/beauty

- Product catalog smaller than ChatGPT or Amazon

- Some categories underrepresented

Amazon Rufus: On-Amazon Dominance, Zero Off-Amazon

Strengths:

1. Native Amazon Integration

- Seamless access to 2 billion Amazon products

- Real customer reviews and Q&A data

- Can answer specific questions from review content

- 274 million daily queries (13.7% of Amazon searches)

- Growing to 25-35% by end 2025

- 250+ million customers used Rufus in 2025

- 60% more likely to purchase (Rufus users vs standard Amazon search)

- Native checkout (no redirect friction)

- On pace for $10 billion incremental annual sales

- All Amazon sellers automatically included

- Optimization via existing listing elements (bullets, A+ content, FAQs)

- No separate platform to manage

- "Is this water bottle dishwasher-safe?" pulls from Q&As

- "Are these individually wrapped?" reads customer reviews

- Contextual understanding of product attributes

1. On-Amazon Only

- Cannot recommend products not sold on Amazon

- DTC brands without Amazon presence: Rufus irrelevant

- Multi-channel retailers: Only captures Amazon slice

- Users already on Amazon when using Rufus

- Doesn't drive new customer discovery (just converts existing Amazon traffic better)

- Top-of-funnel limited

- Reinforces Amazon dependency for sellers

- No customer relationship for merchants (Amazon owns it)

- Limited brand building opportunity

- Marketplace Pulse reports Rufus sometimes provides incorrect answers

- Recommendations not always relevant

- Confidence without accuracy (typical AI limitation)

Which Platform Should I Prioritize by Product Category?

Platform priority by product category should match consumer research behavior and platform strengths: Fashion/Beauty prioritizes ChatGPT first (conversational queries "trendy white sneakers," broad reach, visual product cards), Perplexity second (research-focused for higher-end purchases, specification comparison), Rufus third (on-Amazon only, less discovery-oriented). Electronics/Tech prioritizes Perplexity first (specification-heavy research, desktop users, technical comparisons), ChatGPT second (broad reach, "best laptop for video editing" queries), Rufus for Amazon sellers (native integration, specification answering from Q&As). Home Goods prioritizes ChatGPT first (conversational discovery, visual browsing), Rufus second (Amazon dominates home goods marketplace), Perplexity third (less natural fit). Specialty/Niche prioritizes Perplexity first (research-heavy buyers, longer purchase cycles), ChatGPT second (growing category coverage). Multi-platform approach recommended for most categories; single-platform risks missing 50-70% of AI shopping traffic.

Here's your strategic prioritization framework by product vertical.

Fashion & Beauty Priority Matrix

1st Priority: ChatGPT Shopping

Why ChatGPT Wins:

- Conversational queries natural for fashion ("trendy midi dress under $150 for rooftop wedding")

- Visual product cards showcase fashion/beauty effectively

- Broad demographic reach (41% consumers likely to use AI for clothing)

- Style and aesthetic questions match conversational format

- Use-case driven descriptions (not just "black dress," but "rooftop wedding guest dress")

- Styling recommendations and outfit pairing

- Size and fit guidance in conversational language

- Visual imagery optimized for 16:9 aspect ratio

- Fashion brands: 127% visibility increase, 34% conversion improvement (case study data)

- Beauty brands: 156% new customer acquisition growth via AI discovery

2nd Priority: Perplexity Shopping

Why Perplexity Second:

- Research-focused for higher-end fashion/beauty purchases

- Specification comparison (ingredient analysis, material quality)

- Desktop users researching before purchase

- Material specifications and quality indicators

- Sustainability certifications and ethical sourcing

- Ingredient transparency for beauty products

- Price-to-quality comparisons

- Premium fashion: Higher average order value

- Beauty: Ingredient-conscious buyers (clean beauty, specific skin types)

3rd Priority: Amazon Rufus

Why Rufus Third:

- On-Amazon purchases only

- Less discovery-oriented (users already browsing Amazon)

- Commodity fashion/beauty better fit than high-end

- If you sell fashion/beauty on Amazon (then essential)

- Mass-market price points

- Volume sales vs brand building

Electronics & Tech Priority Matrix

1st Priority: Perplexity Shopping

Why Perplexity Wins:

- Desktop-heavy users (59.7% U.S.) researching specifications

- 23-minute average sessions (deep technical comparison)

- Data-driven recommendations matching tech buyer behavior

- Citation transparency lets users verify specs

- Detailed technical specifications in structured format

- Performance benchmarks and testing results

- Comparison tables (your product vs competitors)

- Use-case scenarios with technical requirements

- 68% more visibility for "best [device] for [specific use]" queries

- 45% increase in average order value (higher-spec products sell better)

2nd Priority: ChatGPT Shopping

Why ChatGPT Second:

- Broad reach captures non-technical buyers

- "Best laptop for video editing" queries (use-case focused)

- Growing electronics category coverage

- Use-case driven (not just specs): "Perfect for video editors rendering 4K"

- Simplified technical explanations

- Common questions answered conversationally

3rd Priority: Amazon Rufus (If selling on Amazon)

Why Rufus Matters for Amazon Sellers:

- 13.7% of Amazon searches (growing to 25-35%)

- Can answer specification questions from Q&As

- Native conversion advantage (60% higher purchase likelihood)

- Comprehensive Q&A section answering technical questions

- A+ content with specification charts

- Customer reviews mentioning technical performance

Home Goods Priority Matrix

1st Priority: ChatGPT Shopping

Why ChatGPT Wins:

- Conversational queries natural: "coffee table for small living room"

- Visual product cards showcase furniture/decor

- Broad category coverage

- Room size and space guidance

- Style descriptions (modern, minimalist, rustic)

- Practical use-case scenarios

- Assembly and maintenance information

- 89% increase in organic discovery

- 52% reduction in returns (better expectation setting)

2nd Priority: Amazon Rufus

Why Rufus Second:

- Amazon dominates home goods online marketplace

- Rufus can answer practical questions ("Will this fit through a standard doorway?")

- On-Amazon conversion advantage

- If significant Amazon sales channel (30%+ revenue)

- Home goods categories Amazon-dominated (storage, organization, small furniture)

3rd Priority: Perplexity Shopping

Why Perplexity Third:

- Less natural fit for home goods (more impulse/visual than research-heavy)

- Desktop-heavy doesn't match mobile browsing behavior for home decor

- Still valuable for higher-end furniture (research-intensive)

Specialty & Niche Products Priority Matrix

1st Priority: Perplexity Shopping

Why Perplexity Wins:

- Research-heavy buyers (specialty = longer research cycles)

- Deep-dive sessions (23 minutes) match specialty purchase behavior

- Citation transparency builds trust for unfamiliar products

- Specialty ingredients (cooking, supplements)

- Professional equipment (cameras, audio, tools)

- Technical hobbyist gear

- Expert-level content demonstrating specialized knowledge

- Detailed specifications and compatibility information

- Use case scenarios from experienced users

2nd Priority: ChatGPT Shopping

Why ChatGPT Second:

- Growing category coverage

- Conversational queries work for education ("What camera for wildlife photography beginner?")

- Broader reach as categories expand

3rd Priority: Amazon Rufus (If applicable)

Only if: Your specialty products sell on Amazon and Amazon represents meaningful revenue share.

---

Platform Priority Summary Table

| Product Category | 1st Priority | 2nd Priority | 3rd Priority | Budget Split |

| ------------------ | -------------- | -------------- | -------------- | -------------- |

| Fashion/Beauty | ChatGPT (50%) | Perplexity (30%) | Rufus (20%) | 50/30/20 |

| Electronics/Tech | Perplexity (50%) | ChatGPT (35%) | Rufus (15%) | 50/35/15 |

| Home Goods | ChatGPT (45%) | Rufus (35%) | Perplexity (20%) | 45/35/20 |

| Specialty/Niche | Perplexity (60%) | ChatGPT (30%) | Rufus (10%) | 60/30/10 |

---

What Are Merchant Integration Requirements?

Merchant integration requirements differ dramatically by platform: ChatGPT Shopping requires Shopify merchants to use Checkout Kit (automatic integration, instant checkout capability) or non-Shopify merchants to apply for API integration (provides product catalog, pricing, availability feeds via RESTful endpoints or GraphQL), Perplexity Shopping requires BigCommerce/Feedonomics partnership integration or direct API connection with Merchant Hub product catalog management (structured product data feeds emphasizing specifications, images, pricing), and Amazon Rufus requires existing Amazon seller account with optimization through listing content only (bullets, descriptions, A+ content 55.1%, FAQs, customer reviews—no separate integration). Implementation complexity: Rufus easiest (zero new integration if selling on Amazon), ChatGPT moderate (Shopify automatic, others require application), Perplexity moderate-to-high (requires partnership or technical API setup). Most accessible: Rufus for Amazon sellers, ChatGPT for Shopify merchants. Most technical: Perplexity for non-partnered merchants.

Here's what you actually need to do to get on each platform.

ChatGPT Shopping Integration

For Shopify Merchants (Easiest):

Requirements:

- Active Shopify store

- Checkout Kit enabled (included with Shopify)

- Product catalog with accurate pricing/availability

- Real-time inventory sync

- Verify Checkout Kit active in Shopify admin

- Ensure product data complete (descriptions, images, pricing, inventory)

- Apply for ChatGPT Shopping access (application-based currently)

- OpenAI reviews and approves

- Products become discoverable in ChatGPT Shopping

Cost: No additional fees beyond Shopify subscription (small transaction fee on completed Instant Checkout purchases)

---

For Non-Shopify Merchants:

Requirements:

- Product catalog API (RESTful or GraphQL)

- Real-time pricing and inventory feeds

- Secure payment processing

- Apply for integration approval

- Apply via OpenAI merchant onboarding

- Technical review of API capabilities

- Integration development (2-6 weeks depending on complexity)

- Testing and QA

- Launch

Cost: Development costs $5K-25K depending on complexity, possible transaction fees

Current Reality: Limited to Shopify/Etsy; other integrations expanding 2025-2026.

---

Perplexity Shopping Integration

For BigCommerce/Feedonomics Merchants:

Requirements:

- BigCommerce platform or Feedonomics product feed management

- Structured product data (clean, organized, specification-rich)

- High-quality product images

- Accurate pricing and inventory

- Enable Perplexity integration via BigCommerce/Feedonomics dashboard

- Configure product feed (ensure data structure meets Perplexity requirements)

- Submit for approval

- Perplexity ingests catalog

- Products appear in search results

Cost: Included with BigCommerce/Feedonomics subscription

---

For Direct API Integration:

Requirements:

- Technical development capability

- Product catalog API

- Structured data feeds (JSON, XML)

- Merchant Hub account application

- Apply for Perplexity Merchant Hub access

- Develop API integration following Perplexity specifications

- Submit product feeds

- Testing and validation

- Launch

Cost: Development $8K-20K, potential revenue share or listing fees (model still evolving)

---

Amazon Rufus "Integration"

For Amazon Sellers (Zero Additional Integration):

Requirements:

- Active Amazon seller account (Seller Central or Vendor Central)

- Existing product listings

- None. Rufus automatically accesses all Amazon listings.

- Enhance product titles (descriptive, benefit-oriented)

- Optimize bullet points (answer common questions)

- Add comprehensive A+ Content (55.1% of Rufus-recommended products use A+ or A+ Premium)

- Build FAQ section answering specific customer questions

- Encourage detailed customer reviews (Rufus reads reviews to answer questions)

Cost: $0 integration, $2K-8K for listing optimization

Note: Cannot integrate off-Amazon products. Rufus only recommends items sold on Amazon.

---

Integration Difficulty Ranking

Easiest → Hardest:

- Amazon Rufus (if you sell on Amazon): Zero integration, optimization only

- ChatGPT Shopping (if you're on Shopify): Automatic via Checkout Kit

- Perplexity (if using BigCommerce/Feedonomics): Dashboard integration

- ChatGPT Shopping (non-Shopify): Requires custom API development

- Perplexity (direct API): Requires custom development

---

How Should I Allocate Budget Across Platforms?

Budget allocation across platforms should follow 60/30/10 rule for multi-platform approach or focus 80-90% on primary platform for resource-constrained teams: Multi-platform budget ($15K-25K monthly) allocates 60% to highest-priority platform ($9K-15K covering product feed optimization, content creation, schema markup, monitoring), 30% to secondary platform ($4.5K-7.5K for basic integration and key product optimization), and 10% to tertiary platform ($1.5K-2.5K for minimal presence and testing). Constrained budget ($8K-15K monthly) allocates 80-90% to single primary platform (ChatGPT for Shopify merchants, Rufus for Amazon sellers, Perplexity for tech brands) with 10-20% reserved for monitoring and testing secondary platform. Platform selection based on: Shopify merchants start ChatGPT, Amazon sellers start Rufus, DTC brands start ChatGPT or Perplexity depending on product category (tech/specialty → Perplexity, fashion/broad → ChatGPT).

Let's make this practical with actual budget allocation examples.

Scenario 1: Multi-Platform Approach ($15K-25K Monthly Budget)

The 60/30/10 Rule:

Primary Platform (60% budget):

- Example: Fashion brand choosing ChatGPT as primary

- Budget: $9K-15K monthly

- Allocation:

Secondary Platform (30% budget):

- Example: Same fashion brand, Perplexity as secondary

- Budget: $4.5K-7.5K monthly

- Allocation:

Tertiary Platform (10% budget):

- Example: Rufus (if selling on Amazon)

- Budget: $1.5K-2.5K monthly

- Allocation:

Total: $15K-25K monthly covering all three platforms

Expected Results:

- 8-15 citations monthly across platforms

- 12-18% of traffic from AI platforms by Month 4

- Multi-platform coverage hedges against single-platform algorithm changes

Scenario 2: Constrained Budget, Single Platform Focus ($8K-15K Monthly)

Strategy: 80-90% on Primary Platform

Fashion Brand (Shopify):

- Primary: ChatGPT Shopping (80% = $6.4K-12K)

- Testing: Perplexity (20% = $1.6K-3K)

- Skip: Rufus (if not selling on Amazon)

- Primary: Perplexity (85% = $6.8K-12.75K)

- Testing: ChatGPT (15% = $1.2K-2.25K)

- Skip: Rufus (not applicable)

- Primary: Amazon Rufus (70% = $5.6K-10.5K)

- Secondary: ChatGPT (30% = $2.4K-4.5K for off-Amazon discovery)

- Consider: Perplexity (if tech/electronics category)

Scenario 3: Testing/Proof-of-Concept ($3K-8K Monthly)

Single Platform, Minimal Viable Presence:

Choose One Platform Based On:

- Shopify merchant → ChatGPT Shopping ($3K-8K: basic integration + 5-10 key products optimized)

- Amazon seller → Rufus ($3K-8K: optimize top 20% of catalog)

- Tech/specialty brand → Perplexity ($3K-8K: integrate + optimize hero products)

Timeline: 3-4 months proof of concept, then decide to scale or expand platforms.

---

Budget Allocation Anti-Patterns (What NOT To Do)

❌ Spread Budget Evenly Across All Three

- $5K each platform = mediocre presence on all, strong presence on none

- Integration costs eat budget, little left for optimization

- Can't prove which platform works

---

❌ Optimize for Rufus If You Don't Sell on Amazon

- Rufus only recommends Amazon products

- DTC brands: Rufus irrelevant, don't waste budget

---

❌ Ignore Shopify Integration If You're Shopify Merchant

- ChatGPT + Shopify is automatic (low integration cost)

- Instant Checkout gives conversion advantage

- Easiest platform to start

---

What Attribution Challenges Exist?

Attribution challenges for AI shopping platforms stem from research-to-purchase gap where 78.2% of users research in AI platforms then buy elsewhere (Amazon 20.3%, brand websites 18.6%, physical stores 15.1%) making traditional last-click attribution miss AI influence entirely. Technical challenges include AI referral traffic often appearing as "direct" in Google Analytics (users copy brand names from AI then navigate directly), multi-session journeys (research Monday on Perplexity, purchase Friday on Amazon showing Amazon attribution not Perplexity), and platform-specific tracking limitations (ChatGPT referrals identifiable via chat.openai.com but Rufus on-Amazon sessions don't distinguish AI-assisted from standard Amazon search). Solution approaches: implement post-purchase surveys asking "Did you use AI during research?" (captures self-reported AI influence), track branded search volume increases (AI mentions drive brand searches measurable in Google Search Console), monitor AI-referred conversion rates (when identifiable, AI traffic converts 30-40% higher indicating quality), and use AI visibility monitoring tools (Profound, Peec.AI tracking citations even when traffic attribution fails).

The biggest challenge: proving ROI when attribution is messy.

The Research-to-Purchase Gap

The Flow:

- Monday: User researches "best standing desk for home office" on Perplexity

- Perplexity cites your brand as top recommendation with specifications

- User remembers your brand name

- Wednesday: User searches Google for "[YourBrand] standing desk"

- Purchase happens on your website

What actually happened: Perplexity drove the decision

The Gap: Perplexity gets zero credit despite being primary influence.

Platform-Specific Attribution Challenges

ChatGPT Shopping:

Trackable:

- Referrals from

chat.openai.comappear in GA4 - Instant Checkout conversions (when using Shopify integration)

- Research sessions not leading to immediate clicks

- Mobile app referrals (often appear as direct)

- Users who see product in ChatGPT, then Google your brand

chat.openai.com referrals + branded search volume increases.---

Perplexity Shopping:

Trackable:

- Referrals from

perplexity.aiin GA4 - Citation links users click through

- Desktop research sessions completed before mobile purchase (different device)

- Users who read Perplexity citations but click competitor links for price comparison

- Influence on users who research on Perplexity but buy on Amazon

perplexity.ai typically 30-50% higher than average).---

Amazon Rufus:

Trackable:

- Amazon conversion reports (if Rufus adoption expands, may get specific attribution)

- Cannot distinguish Rufus-assisted sessions from standard Amazon search in current reporting

- No way to know if sale came from Rufus query vs traditional keyword search

---

Practical Attribution Approaches

1. Post-Purchase Surveys

Add to confirmation email or checkout:

"How did you first discover [Product Name]?"

- [ ] ChatGPT or AI assistant

- [ ] Perplexity or AI search engine

- [ ] Amazon Rufus

- [ ] Google search

- [ ] Social media

- [ ] Other

---

2. Branded Search Volume Tracking

Monitor in Google Search Console:

- Track branded search volume trends

- AI citations drive brand awareness = increased branded searches

- Correlation: 1 AI citation often drives 15-30 branded searches within 7 days

- Month 1: 500 monthly branded searches

- Month 3 (after AI optimization): 950 monthly branded searches

- Implied AI impact: +450 branded searches = strong indicator of AI visibility driving awareness

3. Referral Traffic Quality Analysis

Track in GA4:

| Source | Conversion Rate | AOV | Sessions |

| -------- | ----------------- | ----- | ---------- |

| chat.openai.com | 4.2% | $145 | 850 |

| perplexity.ai | 5.8% | $167 | 320 |

| Organic search | 2.1% | $125 | 8,500 |

| Direct | 3.1% | $135 | 3,200 |

---

4. AI Visibility Monitoring Tools

Use specialized tools:

- Profound ($499/month enterprise): Tracks citations across all platforms

- Peec.AI (mid-market): Citation monitoring and visibility scoring

- Manual sampling (free): Weekly queries across platforms documenting citations

- Citation frequency (how often mentioned)

- Citation context (primary source vs mentioned alongside competitors)

- Product categories getting most citations

- Competitor citation share

The Attribution Reality

Perfect attribution doesn't exist for AI shopping yet.

Platforms haven't built comprehensive tracking. Multi-touch journeys complicate measurement.

What you can measure:

- Direct referral traffic (when it happens)

- Branded search volume increases

- Post-purchase survey data

- AI citation frequency (via monitoring tools)

- Overall traffic/revenue trends correlated with AI optimization efforts

- If branded searches increase 40% after AI optimization

- If referral traffic from AI platforms (even small %) converts at 3-5x higher rate

- If post-purchase surveys show 30%+ discovered via AI

---

FAQ

Q: Should I optimize for all three platforms or focus on one?

A: Focus on 1-2 platforms initially based on your situation, then expand as you prove results. Shopify merchants should start ChatGPT Shopping (automatic integration, instant checkout), Amazon sellers should start Rufus (zero integration, optimization only), and DTC tech/specialty brands should start Perplexity (research-focused buyers). Multi-platform approach (optimizing all three simultaneously) works if budget exceeds $20K monthly and team can manage complexity, but most mid-market brands ($8K-18K budget) achieve better results focusing 70-80% effort on primary platform proving ROI before expanding. Exception: If selling on Amazon AND Shopify, optimize both Rufus (on-Amazon) and ChatGPT (off-Amazon discovery) from day 1 since integration requirements minimal.

Q: How long does it take to see results from AI shopping platform optimization?

A: Results timeline varies by platform: ChatGPT Shopping shows first product recommendations within 30-45 days of feed integration and content optimization with measurable referral traffic by day 60-90, Perplexity Shopping shows citations within 45-60 days for well-optimized technical products with referral traffic building gradually (research sessions precede purchases by days/weeks), and Amazon Rufus shows immediate impact since already live (optimization improvements appear within 7-14 days as Rufus re-crawls listings). Fastest results: Rufus for Amazon sellers (immediate). Moderate: ChatGPT Shopping (30-45 days). Slower but higher intent: Perplexity (45-60 days). Full traffic impact (15-20% from AI platforms) typically requires 90-120 days across all platforms as citation patterns establish and compound.

Q: Do I need different product content for each platform or can I use the same optimization?

A: Use foundational optimization across all platforms (accurate specifications, conversational descriptions, comprehensive FAQs, high-quality images) but layer platform-specific elements: ChatGPT optimization emphasizes use-case scenarios and styling recommendations in conversational tone ("Perfect for rooftop weddings," "Ideal for video editors rendering 4K"), Perplexity optimization adds data-driven specifications with technical comparisons and performance benchmarks (specification charts, testing results, material certifications), and Rufus optimization focuses on answering specific customer questions via Q&As and encouraging detailed reviews mentioning product attributes. Same core content (comprehensive, conversational, well-structured) works everywhere; platform-specific layer enhances performance on each channel. Don't create completely separate content per platform (inefficient); create universal high-quality foundation then add platform-specific optimization elements.

Q: What if I don't sell on Amazon—is Rufus still relevant?

A: No. Amazon Rufus only recommends products sold on Amazon marketplace; it cannot and will not recommend off-Amazon products regardless of quality or optimization. If you're DTC-only brand (Shopify, WooCommerce, BigCommerce) without Amazon presence, Rufus is completely irrelevant to your AI visibility strategy. Focus budget on ChatGPT Shopping (broad reach, Shopify integration if applicable) and Perplexity (research-focused buyers, direct checkout partnerships). Only consider Amazon/Rufus if: you're willing to sell on Amazon marketplace (wholesale or seller fulfilled), Amazon aligns with brand strategy and margin requirements, and Amazon represents meaningful revenue opportunity (typically 20-40% of e-commerce revenue for brands selling there). Don't optimize for Rufus if you're not on Amazon; it's wasted investment.

Q: How do conversion rates compare across the three platforms?

A: Conversion rate data shows platform-specific patterns: AI-referred traffic generally converts 30-40% higher than traditional search across all platforms due to pre-qualified research behavior, with Perplexity-referred traffic converting highest (often 50-70% higher than baseline due to desktop research sessions, 23-minute average indicating serious purchase intent, specification-focused buyers pre-qualified before clicking), ChatGPT-referred traffic converting 30-45% higher (conversational discovery builds confidence, organic rankings create trust, instant checkout reduces friction for Shopify integration), and Amazon Rufus showing 60% higher purchase likelihood versus standard Amazon search (native ecosystem, no redirect friction, contextual understanding matching intent). However, absolute conversion volume differs: ChatGPT drives most total conversions (highest traffic volume), Perplexity drives highest-value conversions (research-intensive = higher AOV), Rufus drives most on-Amazon conversions (native integration advantage).

Q: What's the ROI timeline for optimizing each platform?

A: ROI timeline by platform: ChatGPT Shopping reaches break-even Month 3-4 (initial integration Month 1: $5K-15K, first referrals Month 2, meaningful traffic Month 3-4) with positive ROI Month 5+ achieving 200-300% by Month 12 for Shopify merchants with instant checkout. Perplexity Shopping reaches break-even Month 4-6 (integration Month 1-2: $8K-20K for non-partnered merchants, citations Month 3-4, conversions Month 5-6 as research leads to delayed purchases) with positive ROI Month 7+ achieving 180-250% Month 12 due to smaller traffic volume but higher conversion rates and AOV. Amazon Rufus reaches break-even Month 2-3 (optimization Month 1: $2K-8K, immediate impact as Rufus already live, measurable sales lift Month 2-3) with positive ROI Month 4+ achieving 250-350% Month 12 for Amazon-heavy sellers. Fastest ROI: Rufus for existing Amazon sellers. Best long-term: ChatGPT for Shopify merchants. Highest conversion quality: Perplexity for tech/specialty.

Q: Should I prioritize the platform with most users or best conversion?

A: Prioritize based on your specific business model and constraints: Choose largest user base (ChatGPT Shopping with 53% shopper adoption, 1B weekly searches) if you need volume discovery, have broad product catalog, target mass market categories (fashion, beauty, home goods), or are Shopify merchant (automatic integration reduces barrier). Choose best conversion (Perplexity with research-focused, 23-minute sessions, desktop-heavy serious buyers) if you sell higher-priced items ($200+), have technical/specialty products, target research-intensive categories (electronics, professional equipment), or can afford longer sales cycles (research today, purchase next week). Choose native integration (Amazon Rufus 60% higher purchase likelihood) if 30%+ revenue from Amazon, want lowest integration cost ($0), or need fastest time-to-revenue (immediate). Most brands benefit from starting where integration easiest and user behavior matches category (Shopify → ChatGPT, Amazon → Rufus, Tech → Perplexity), prove ROI, then expand.

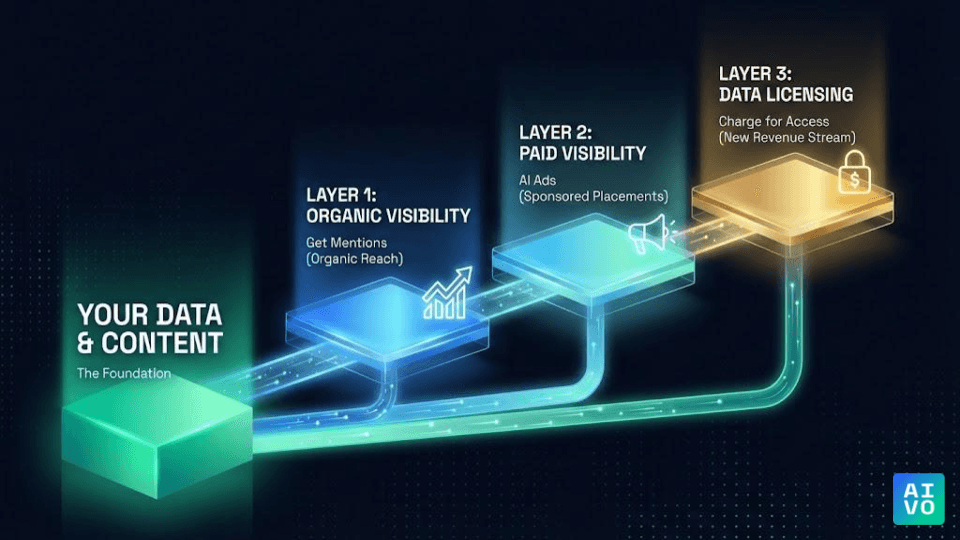

Q: Will these platforms add advertising options that change the strategy?

A: Yes, advertising options are coming and will change optimization strategy: ChatGPT Shopping currently maintains organic-only rankings (no sponsored placements) but OpenAI exploring affiliate revenue models and premium placement options likely 2025-2026, Perplexity likely to add sponsored product placements as revenue model evolves from current pure citation approach, and Amazon Rufus may integrate sponsored products within AI answers (similar to traditional Amazon search ads) as Amazon seeks to monetize $10B sales opportunity. Strategic implication: early organic optimization (2025) establishes citation history and authority before paid placements launch, making current window critical for building foundational visibility that compounds even after ads introduced. Brands establishing strong organic presence now will likely pay less for ads later (similar to how strong organic Amazon rankings reduce PPC requirements). Don't wait for ads to launch; organic optimization creates lasting advantage.

---

Key Takeaways

The Platform Landscape: Three platforms dominate e-commerce AI shopping: ChatGPT Shopping (highest adoption at 53% shoppers, 1 billion weekly searches, instant Shopify checkout), Perplexity Shopping (15M monthly users, research-focused with 23-minute sessions, 59.7% desktop serious buyers), and Amazon Rufus (13.7-25% of Amazon searches, 274M daily queries, $10B sales trajectory, on-Amazon only).

Adoption and Growth: AI shopping traffic grew 1,300-1,950% YoY with traffic doubling every 2 months since September 2024. 58% of consumers now use Answer Engines for product research, with 79.7% relying on AI for at least half of purchase decisions. Demographic leaders: Millennials 46% adoption, higher-income Millennials 50%+, Baby Boomers +63% growth indicating rapid mainstream adoption.

Platform Priority by Category: Fashion/Beauty prioritizes ChatGPT (conversational, visual, 41% likely usage) then Perplexity (premium research) then Rufus (on-Amazon commodity). Electronics/Tech prioritizes Perplexity (specifications, desktop research, technical) then ChatGPT (broad reach) then Rufus (Amazon sellers). Home Goods prioritizes ChatGPT (conversational discovery) then Rufus (Amazon dominance) then Perplexity. Specialty/Niche prioritizes Perplexity (research-heavy, longer cycles) then ChatGPT.

Integration Complexity: Rufus easiest (zero integration if selling on Amazon, optimization only), ChatGPT moderate (Shopify automatic via Checkout Kit, others require API application), Perplexity moderate-high (BigCommerce partnership or custom API development). Shopify merchants start ChatGPT, Amazon sellers start Rufus, DTC brands evaluate ChatGPT vs Perplexity based on category.

Budget Allocation Framework: Multi-platform ($15K-25K monthly): 60% primary platform, 30% secondary, 10% tertiary. Constrained budget ($8K-15K): 80-90% single primary platform, 10-20% testing secondary. Proof-of-concept ($3K-8K): Single platform only, prove ROI before expanding. Don't spread budget evenly across all three (mediocre presence everywhere, strong presence nowhere).

Attribution Challenges: Research-to-purchase gap where 78.2% research in AI then buy elsewhere (Amazon, brand sites, stores) breaks last-click attribution. Solutions: post-purchase surveys (self-reported AI influence), branded search volume tracking (AI citations drive brand searches), referral traffic quality analysis (AI traffic converts 30-40% higher when identifiable), and AI visibility monitoring tools (track citations even when traffic attribution fails).

Strategic Recommendation: Don't try to optimize all platforms simultaneously unless budget exceeds $20K monthly. Choose primary platform based on: Shopify merchants → ChatGPT (automatic integration), Amazon sellers → Rufus (zero integration), tech/specialty brands → Perplexity (research buyers), fashion/broad → ChatGPT (conversational, visual). Prove ROI on primary platform (90-120 days), then expand to secondary platform with learnings applied.

Start Here: Run free AI visibility audit to see current presence across ChatGPT and Perplexity. Check if products appear when users ask relevant questions. Use baseline to determine which platform offers quickest wins for your catalog.

Need Multi-Platform Strategy?

- E-commerce AI Visibility Services - We handle ChatGPT, Perplexity, Rufus optimization

- Managed Implementation - Full platform integration and optimization ($15K/month)

- Strategy & Roadmap - Platform prioritization guidance for your category ($8K/month)

- Free Consultation - Platform recommendation based on your product mix and current sales channels

Related Resources

AIVO Resources:

- Zero-Click Crisis Analysis - Understanding AI-driven traffic shifts

- ChatGPT SEO Optimization Guide - Deep-dive on ChatGPT optimization

- REVEAL Framework Methodology - Systematic multi-platform approach

- AI Visibility Tools Directory - Tools for monitoring platform performance

- OpenAI Agentic Commerce Protocol - ChatGPT Shopping documentation

- Adobe Digital Economy Index - AI shopping traffic data

- Profound AI Shopping Study - Consumer behavior research

About This Comparison

This analysis draws from Adobe's survey of 5,000 U.S. consumers (February 2025), Profound's study of 1,600 respondents on AI shopping behavior, Amazon AWS data on Rufus compute allocation enabling usage calculation, and Perplexity traffic statistics from Semrush (March 2025). All adoption statistics, conversion rates, and platform capabilities verified from official sources as of November 2025.

Disclosure: AIVO provides e-commerce AI visibility optimization across ChatGPT, Perplexity, and Amazon Rufus as part of our Managed Implementation service. This comparison aims for objectivity while acknowledging our multi-platform expertise. Platform recommendations based on product category, merchant infrastructure, and budget constraints—not on platform preferences.

Last Updated: November 24, 2025 Research Date: November 24, 2025 Next Review: February 2026